Amortization Period Impact

How the Amortization Period Impacts Your Mortgage

The recent announcement from Ottawa allowing first-time homebuyers to secure an insured mortgage with a 30-year amortization period, up from the previous 25-year limit, has significant implications for borrowers. This change highlights the fact that different amortization periods are possible and that it is important for Canadian mortgage borrowers to understand how the amortization period affects the cost of their mortgage. While extending the amortization period can reduce monthly payments and provide a more affordable entry point into the housing market, it will increase the total cost of the mortgage over time.

Let’s delve into the details and explore how borrowers can address this issue effectively.

The Basics of Amortization

Amortization refers to the length of time it would take to pay off your mortgage at the current mortgage rate. The amortization period assumes regular monthly mortgage payments. Each monthly mortgage payment covers both the interest on the loan and a portion of the principal amount. After every monthly payment, the remaining principal balance of your mortgage is reduced by the portion of the payment that goes toward principal. Over the amortization period the remaining principal balance will decline to zero.

You will hear and read that the longer 30-year amortization period is good for mortgage borrowers. However, there is a trade-off in selecting the longer amortization period that borrowers need to be aware of. The benefit is that the longer the amortization period, the lower the monthly payments. Stretching out the repayment schedule results in a lower required payment per payment period. The longer amortization period can help borrowers qualify for a mortgage. A longer amortization may also provide some payment relief for existing borrowers struggling with a mortgage renewing at high rates. The trade-off to this short-term payment reduction is that the longer amortization results in a higher amount of interest paid over the life of the loan. In other words, the short-term relief from a longer amortization comes at a cost.

Numerical Examples

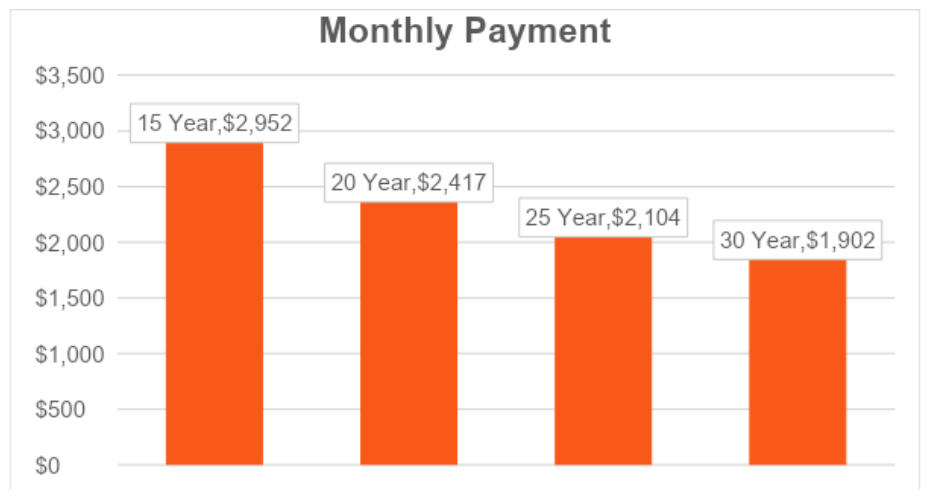

Let’s consider a mortgage of $400,000 with an interest rate of 4%. The chart below shows the difference in monthly mortgage payments for different amortization periods.

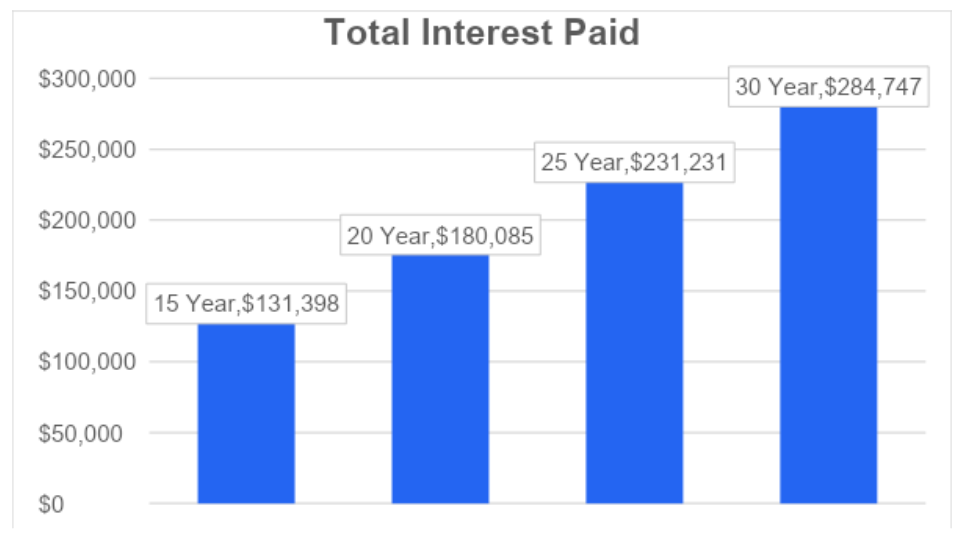

While 25-year and 30-year amortization periods are the norm, it is possible to select even shorter amortization periods. The impact on total cost of a mortgage can be material:

The recent announcement that 30-year amortization periods are permitted on insured mortgages for first-time homebuyers and buyers of new build properties has everyone focused on 30-year versus 25-year amortizations.

25-Year Amortization:

- Monthly Payment: $2,104

- Total Interest Paid Over 25 Years: $231,231

30-Year Amortization:

- Monthly Payment: $1,902

- Total Interest Paid Over 30 Years: $284,747

Using a $400,000 mortgage at a 4% mortgage rate, we see that the monthly payment for a 30-year amortization is lower by $202, providing immediate cash flow savings. However, the total interest paid over the life of the mortgage is higher by $53,516, resulting in a higher overall cost for the mortgage.

If you are unsure whether a 30-year amortization is right for you, please seek advice from an advisor or experienced mortgage broker.

When to Consider a Longer Amortization Period

There are several circumstances where a longer amortization period can make sense. Note that if any of these apply to you that you should also consider the mitigation strategies noted below.

- First-Time Homebuyer – housing is expensive and qualifying for a mortgage can be difficult. If you are just missing out on qualifying for an insured mortgage to purchase your first home, then you may be able to qualify at the lower monthly payment amount produced by a 30-year amortization;

- Refinancing at Mortgage Renewal – When you renew your mortgage with your current lender you remain on the current remaining amortization schedule. Renewing into higher interest rates means you will have a higher payment and if this is unaffordable you may consider refinancing into a longer amortization period. On a refinancing you will be limited to a maximum 25-year amortization period but that may be enough to help reduce the burden of the higher monthly payment.

- Refinancing during the term of the mortgage - This could allow you to take advantage of recent declines in interest rates, in addition to getting a longer amortization to lower your monthly payment. If you want to do this during the term of the mortgage you need to carefully consider the prepayment penalty you will owe for breaking the mortgage early.

Strategies to Mitigate the Costs of a Longer Amortization Period

Once you take on a mortgage, there are ways to accelerate paying down the mortgage. Anything you do to pay down the mortgage early shortens the remaining amortization. If you employ any of the following strategies, you can mitigate the long-term additional costs of taking a longer amortization at the outset of your mortgage.

- Make Extra Payments:

- Increase Payment Frequency: Switching from monthly to bi-weekly or weekly payments will reduce the amortization period. Each time a weekly or bi-weekly payment is made, some principal is paid down. This reduces the interest owed for the next period. It may seem like a small amount per payment but over the life of the mortgage it makes a material difference.

- Utilize Prepayment Privileges:

Most mortgages come with prepayment privileges that allow borrowers to make lump sum payments of principal to pay down their mortgage faster. Whenever possible, make lump sum payments towards the principal. This can significantly reduce the principal amount and remaining amortization, reducing the amount of interest paid over the life of the mortgage.

- Increase Monthly Payment Amounts:

- Annual Payment Increase: Most mortgage agreements allow borrowers to increase their monthly payment amount once annually. A higher monthly payment will shorten the amortization period and reduce the total interest paid over the life of the mortgage. Refinance to a Shorter Amortization Period:

- Refinance to a Shorter Amortization Period:

- Refinancing: Just because you took a longer amortization at the outset doesn’t mean you have to renew your mortgage on the same amortization schedule. You can consider refinancing the mortgage to a shorter amortization period if you can afford the higher payment.

Conclusion

While a 30-year amortization period on a new, insured mortgage offers lower monthly payments and immediate cash flow benefits, it also results in higher total interest costs over the life of the mortgage. By understanding these dynamics and employing strategies such as making extra payments, increasing payment amounts, refinancing, and utilizing prepayment privileges, borrowers can proactively manage and reduce the overall cost of their mortgage.

Understanding the impact of amortization periods is crucial for making informed decisions about your mortgage. If you want to talk about your mortgage options, why not talk to the mortgage broker that will place you first and openly show you what is best for you. That’s Frank Mortgage and we can be reached at 1-888-850-1337 or at www.frankmortgage,com. We are here to help.

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts