Prime Rate Canada

Why Does it Matter to Mortgage Borrowers?

Canadian mortgage borrowers have experienced stress over the past two years due to increasing interest rates. News headlines commonly refer to the prime rate, noting the frequent changes in the prime rate and the impact it has on variable-rate mortgage borrowers. Recently, the prime rate has been declining. This is good news but, as a mortgage borrower, do you understand how the prime rate affects you?

5.95%

Current Prime Rate

What is the prime rate?

The prime rate is most commonly defined as the interest rate commercial banks charge their most credit-worthy customers. It serves as a benchmark rate for setting the rates on a variety of financial products, including mortgages, personal loans, and lines of credit. The prime rate is influenced by several factors, including inflation, economic growth, and the supply and demand for credit.

The prime rate is determined by the banks themselves, and it is typically set at a level that is 1.5 to 2.5 percentage points above the overnight lending rate set by the Bank of Canada. The prime rate has been declining in recent moths and is currently (as of October 23, 2024) 5.95%.

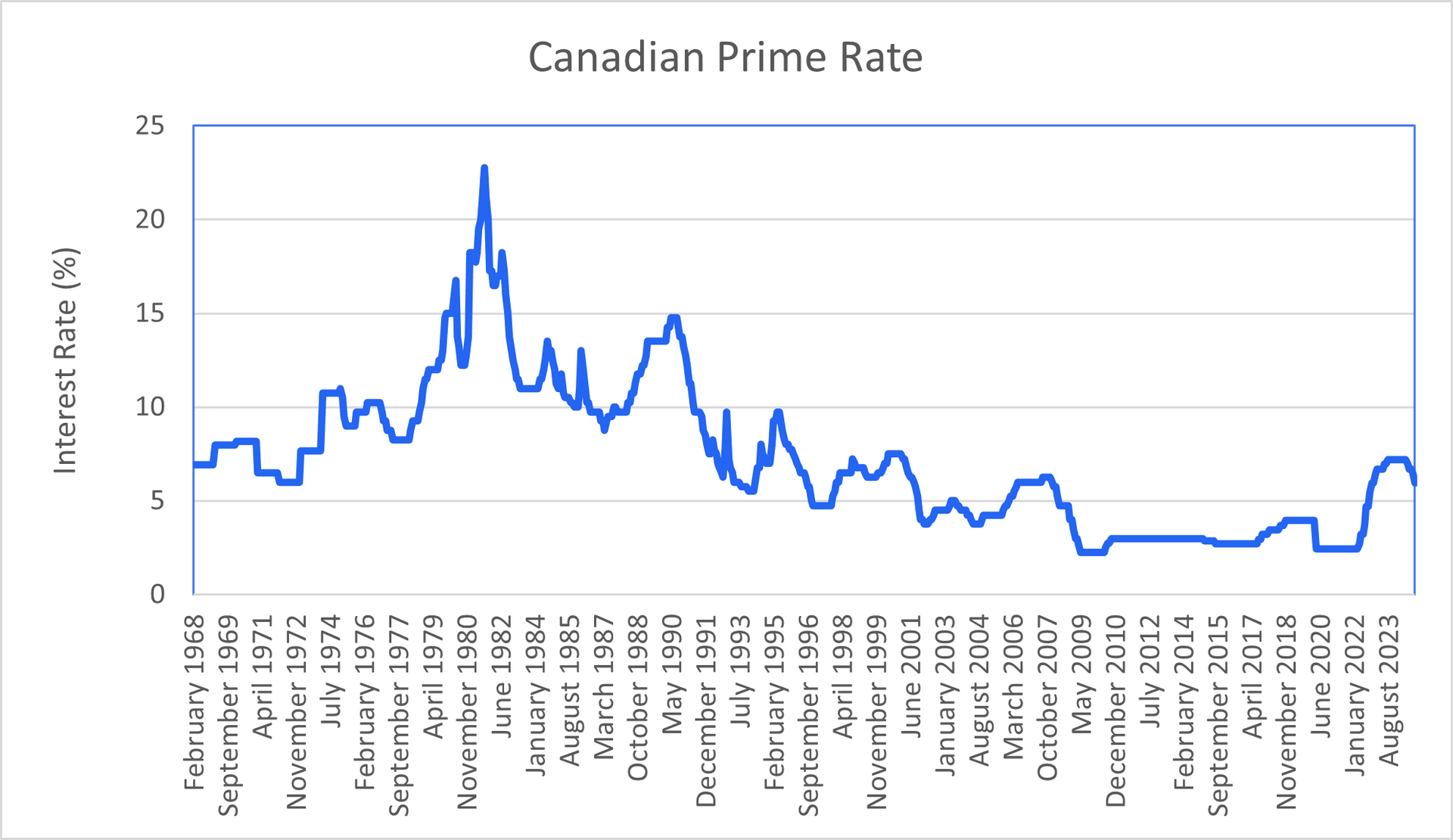

While the current prime rate appears high to us today, that is because it had been unusually low over the past decade. The average Prime Rate over the past 50 years is 7.20%, compared to today’s Prime Rate of 5.95%.

How is the prime rate determined?

Each Canadian bank sets their own prime rate. They generally end up being the same rate, with no difference between the banks. Independent mortgage lenders do not set their own prime rate. They reference one or more of the big banks and use their prime rates as their reference prime rate.

The Bank of Canada's monetary policy is a key determinant of the prime rate even though it does not directly set it. The Bank of Canada uses its benchmark overnight lending rate to regulate the nation's economic growth and restrain inflation. The Bank of Canada influences short-term interest rates by adjusting the target for the overnight rate on eight fixed dates each year.

When the Bank of Canada changes the overnight rate, the Canadian banks usually change their prime rates within a couple days. They tend to move their prime rates by the same amount and in the same direction that the Bank of Canada moves the overnight lending rate.

How do banks use the prime rate?

Banks use the prime rate as a benchmark rate for a variety of financial products, including mortgages, personal loans, and lines of credit. The interest rate charged for these products is typically set at a margin above or below the prime rate. Most products will have a rate of Prime plus a margin but variable rate mortgages for the best borrowers are usually priced at Prime minus a margin. For example, a bank might offer a variable-rate mortgage at a rate of prime minus 1% (equal to 4.95% today). As the Prime Rate moves up or down the variable mortgage rate will move also, but the margin stays the same for the term of the mortgage.

How are variable rate mortgage rates set relative to the prime rate?

Variable rate mortgages are directly tied to the prime rate. When the prime rate goes up, so does the interest rate on a variable rate mortgage. Conversely, when the prime rate goes down, so does the interest rate on a variable rate mortgage. This means that borrowers with variable rate mortgages are exposed to interest rate risk, as their mortgage payments can increase if the prime rate increases.

The margin relative to the prime rate depends on market conditions, the risk profile of the borrower and the costs of lending. When market conditions are positive, the margin for the best borrowers can be as much as minus 1.50%. When market conditions worsen, that margin can be as small as 0.25% to 0.50%.

As an example, using today’s prime rate, the rate on a variable rate mortgage might be 4.95%:

5.95% - 1.00% = 4.95%

If the prime rate was reduced by 0.25% to 5.70%, the rate on a variable-rate mortgage would become:

5.70% - 1.00% = 4.70%

The margin of 1.00% stays the same for the term of the mortgage but the mortgage rate will change when the prime rate changes.

The prime rate is usually the same for all banks. They will use this base prime rate for pricing variable rate mortgages and the competitive difference in rate is the margin below the prime rate that they offer. However, there is one bank that does things differently. TD Bank uses a prime rate for mortgage lending that is equal to their prime rate plus 0.15%. They have been doing this since 2016. Borrowers should note this since TD needs to offer a larger margin discount to their prime rate to get you to the same rate being offered by other lenders.

Check Out Frank Mortgage’s Best Current Mortgage Rates

Is Today’s Prime Rate Historically High?

The prime rate fluctuates over time. There have been significant increases in the past, primarily due to central bank efforts to tame inflation, very similar to what happened in Canada in 2022. The current prime rate seems very high but is it really that high when compared to the past? The answer is yes, when you compare it to recent history. However, the business and interest rate cycles run over a long time period and when you look back further in history, today’s prime rate looks fairly normal:

| Prime Rate | BoC Overnight Rate | Difference | |

|---|---|---|---|

| 50 Year Average | 7.23% | 5.54% | 1.69% |

| 20 Year Average | 3.72% | 1.70% | 2.02% |

| 10 Year Average | 3.54% | 1.36% | 2.18% |

A 5.95% prime rate is higher than recent history but relatively average when looking back over the long-term. Rates have steadily declined over the past 40 years, so it makes sense that recent average rates would be lower. That period of consistent decline appears now to be over.

Note also that the difference between the prime rate and the BoC overnight rate has increased over time. The long-term, 50-year average difference is 1.69%. That difference today is 2.20% (5.95% prime rate versus 3.75% BoC target overnight rate). Banks are now charging more for their prime rate than they did in the past.

What is the historic margin between variable mortgage rates and the Prime Rate?

The historic margin between variable mortgage rates and the prime rate has varied over time. In general, the margin tends to be a discount ranging between 0.5% and 1.5%, depending on market conditions and the risk profile of the borrower. During times of economic uncertainty or when credit conditions are tight, banks may offer less of a discount margin to account for increased risk.

Can anyone predict where the prime rate will go in the future?

Predicting where the prime rate will go in the future is difficult. It is influenced by a wide range of factors and, as we saw in 2022, can be subject to sudden changes. Some economists and analysts use models to forecast the future direction of interest rates, but these projections are often imprecise and subject to error. Ultimately, the direction of the prime rate will depend on a variety of economic factors that influence the rate setting policy of the Bank of Canada, including inflation, economic growth, and the supply and demand for credit.

Trying to predict the future direction of interest rates can be a risky exercise for a mortgage borrower. Just look at what happened to variable-rate mortgage holders in 2022. Many took out variable rate mortgages when rates were very low and are now experiencing financial stress due to higher rates. A fixed-rate mortgage would have been a better decision. Looking at a variable-rate mortgage as an opportunity to benefit from rates declining without considering the risk if rates were to increase is a poor analysis. The best analysis for most of us is to find the rate that we can afford that we can lock-in for as long as possible. Making a bet on Interest rates is arguably inappropriate for a homeowner that is trying to secure financing for their house. It is a material risk. Assess your risk tolerance and understand what happens if your bet on rates does not work out. Taking interest rate risk is only appropriate for the minority of us that can afford to be wrong.

Most Recent Bank of Canada Rate News

The Bank of Canada cut their benchmark interest rate a further 0.50% on October 23. This is the fourth consecutive cut, bringing the benchmark rate down to 3.75%, from its high earlier this year of 5.0%

A 0.50% rate cut is a significant signal to the market and follows on the 0.50% rate cut by the US Federal Reserve. Central banks are clearly comfortable that inflation is now under control and they are attempting to stimulate the economy to avoid recession.

The 1.25% cumulative decline in the benchmark Bank of Canada rate since June means a 1.25% decline in variable mortgage rates. This represents monthly payment savings for variable-rate mortgage holders of close to $70 for every $100,000 of mortgage. For new homebuyers these lower variable rates create close to 10% in added buying power.

Despite these rate cuts, variable mortgage rates remain higher than fixed mortgage rates - the best variable mortgage rates will now be in the high 4% range while the best fixed rates are in the low 4% range. Additional rate cuts are anticipated, which could soon lead to a more typical rate environment where variable rate are below fixed rates.

We do not expect variable mortgage rates to return to the lows seen a couple years ago (remember when they were 0.99%?). Several banks now expect the Bank of Canada to reduce their benchmark rate to 2.25% by the end of 2025. This would bring the lowest variable mortgage rates into the mid-3% range.

Fixed mortgage rates have also dropped since the Bank of Canada began cutting rates in June, though not as significantly. Recently they have levelled off and are not declining in response to today's Bank of Canada rate cut. They are down about 0.60% since the first rate cut in June, compared to 1.25% for variable rates. This shows that the Bank of Canada rate cuts impact variable rates more than fixed rates. Some bank analysts have estimated that fixed rates are unlikely to decline by more than 0.50% in the next year, if at all. When evaluating your mortgage needs, you should weigh the possibility that fixed mortgage rates may not decline much further.

In their accompanying statement the Bank of Canada stated that "With inflation now back around the 2% target, Governing Council decided to reduce the policy rate by 50 basis points to support economic growth and keep inflation close to the middle of the 1% to 3% range. If the economy evolves broadly in line with our latest forecast, we expect to reduce the policy rate further."

They also stated that "The Bank’s preferred measures of core inflation are now below 2½%. With inflationary pressures no longer broad-based, business and consumer inflation expectations have largely normalized.."

Inflation has been steadily declining, falling below the 2% target rate in September to 1.6%. The cumulative effect of these four consecutive rate cuts is now material and improves affordability for mortgage borrowers. While some may wait for more cuts, we are seeing an increase in activity in the housing and mortgage markets. If you want to explore what the current buyer's market in housing and improving mortgage affordability might mean for you, now is the time to reach out to us at Frank Mortgage to see what is possible. Please click below to search for rates or to arrange to speak with us.

The prime rate at the banks declined from the 6.45% to 5.95%.

You can read the Bank of Canada's full press release here - Bank of Canada reduces policy rate by 50 basis points to 3¾% - Bank of Canada

There is one more Bank of Canada rate announcement scheduled in 2024, on December 11.

Final Word

The Canadian bank prime rate plays an important role in the country's financial system, serving as a benchmark rate for a variety of financial products. While the Bank of Canada does not directly set the prime rate, it does have an indirect influence on it through its monetary policy. Banks use the prime rate as a basis for setting interest rates on loans and lines of credit, and borrowers with these variable-rate products, such as variable-rate mortgages, are exposed to interest rate risk. While predicting the future direction of the prime rate is difficult, understanding how it is determined and how it is used by banks and borrowers can help individuals make informed financial decisions.

If you have a variable rate mortgage you need to be aware that rates may unexpectedly increase. We hear some advocates suggesting that rates will definitely come down even more in the latter half of 2024 and into 2025. This is a popular view and we also believe it is likely to happen. But nobody really knows this. Manage your own affairs without trying to guess where rates are going. Variable-rate mortgages contain risk and are not for everyone.

If you are in the market currently for a mortgage, a fixed rate might be the best solution. With no exposure to interest rate risk during the term of the mortgage, a fixed-rate mortgage is the conservative choice for the majority of us that have a low risk tolerance.

Let Frank Mortgage Help Find You Your Best Mortgage Deal

(Click here to Register and Take Advantage of our proprietary mortgage system)

Prime Rate FAQs

The Bank of Canada is Canada’s central bank. The main function of a central bank is to promote the economic and financial welfare of Canada by overseeing monetary policy, influencing interest rates, issuing bank notes, and supervising Canada's financial institutions.

Established in 1934, the Bank of Canada operates as a Crown corporation under the Bank of Canada Act. As part of its operational role, the Bank of Canada is responsible for setting the target for the overnight interest rate. This is the rate at which major financial institutions lend and borrow money from each other on an overnight basis. The overnight rate affects the rates that the banks offer of credit products. As a result, it influences the cost of borrowing for consumers and businesses and, therefore, the overall level of economic activity in the country.

The Bank of Canada also plays a critical role in managing Canada's foreign reserves and providing financial services to the Canadian government. The Governor of the Bank of Canada is appointed by the government, reporting directly to the Minister of Finance.

Canadian banks change their prime rate is response to changes in the overnight rate that is set by the Bank of Canada. Banks set the prime rate at a margin above the overnight rate. As a result, when the overnight rate moves up or down, the prime rate will also move up or down.

The Bank of Canada sets the target for the overnight interest rate eight times a year, in a series of announcements known as "Monetary Policy Reports" or "Interest Rate Decisions." These announcements are scheduled at the beginning of each year and are made by the Bank's Governing Council. In rare instances the Bank of Canada may also hold emergency meetings where changes to the overnight rate can be announced. The last time this happened was early in the covid pandemic.

| Bank of Canada 2024 Interest Rate Decision Announcement Dates |

|---|

| Jan 24 |

| Mar 6 |

| Apr 10 |

| Jun 5 |

| Jul 24 |

| Sep 4 |

| Oct 23 |

| Dec 11 |

There are no guarantees when it comes to interest rates, but the reason for the dramatic increase in the prime rate in 2022 was the dramatic increase in inflation. It is the widely held expectation in the market that once inflation is reduced to a level closer to the Bank of Canada’s 2% target level that the overnight rate would be reduced. If this were to occur, it would lead to a lower prime rate as well.