Canadian Mortgage Rate Forecast For 2024

Where are interest rates going in 2024? Lower, or higher? What are the key things to look for to be able to make a prediction and what happens if rates change? There are so many questions about mortgage rates, but it is nearly impossible to make an accurate interest rate prediction. That is the one thing about future interest rates for which we are certain.

There has not been a time in recent memory where interest rates dominate the mortgage market discussion like it has for the past two years. With over 2.2 million mortgages renewing into higher rates in the next two years and mortgage affordability being stressed by higher rates, this is understandable.

One thing that younger generations need to adjust to is the fact that the current level of interest rates is historically normal. The anomalous time was the prior ten years when rates were artificially suppressed by central banks. While some rate relief might be in the cards for 2024, a return to those low rates seems unlikely.

Before talking about the predictions for 2024 let’s look into some background information regarding mortgage rates.

What Interest Rates Affect Mortgage Rates?

There are two key underlying market rates that mortgage borrowers should be aware of:

1. The Prime Rate

The prime rate is defined as the interest rate commercial banks charge their most credit-worthy customers. It serves as a benchmark rate for setting the rates on a variety of financial products, including mortgages, personal loans, and lines of credit. The prime rate is influenced by several factors, including inflation, economic growth, and the supply and demand for credit.

The prime rate is determined by the banks themselves, and it is typically set at a level that is 1.5 to 2.5 percentage points above the overnight lending target rate set by the Bank of Canada. The prime rate is currently (January 18, 2024) 7.20%, the highest it has been in over twenty years.

2. The Five-Year Canada Bond Yield

There are a variety of Canada government bonds that trade daily in the bond market. They have terms to maturity ranging from overnight to 30-year bonds. The five-year Canada bond is a benchmark pricing bond for mortgages. This is because mortgage funding vehicles like mortgage-backed securities are priced off this bond.

The bond market sets the price of the bonds, and the bonds are forward looking. This means their current price is influenced by bond investor’s view of the future economic prospects of the country that issued the bonds. Factors like economic growth, employment and inflation influence the price of the bonds. The five-year government of Canada bond yield is currently 3.54%. It ended 2023 at 3.17% and was as high as 4.42% in October 2023. It can move around quite a bit.

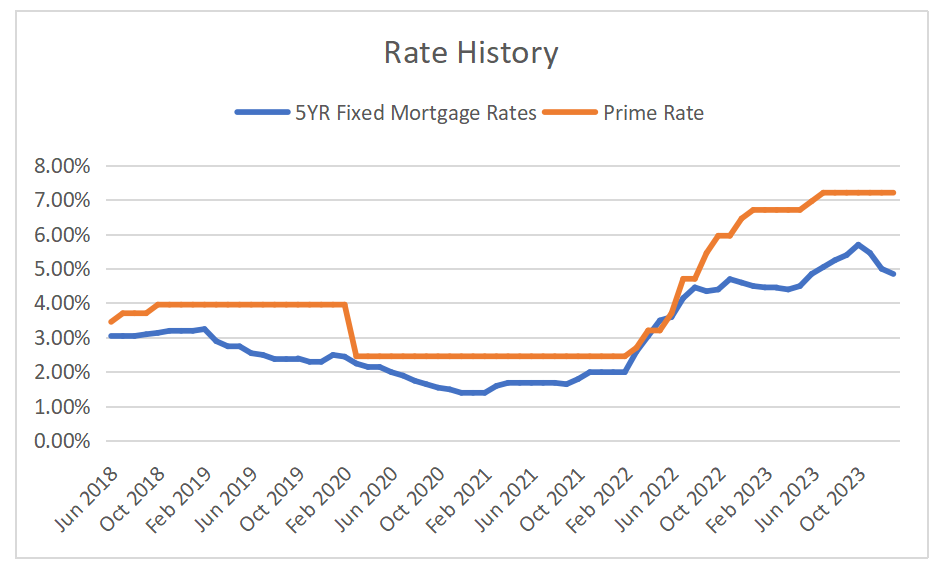

Recent History of Canadian Mortgage Rates

Rates have been lower than historical averages since the economy exited from the financial crisis. There have been some ups and downs, such as the reduction of rates in response to the covid lockdowns.

Unfortunately, an extended period of low rates combined with massive government stimulus in response to the covid lockdowns, has fueled a period of inflation. In response, central banks rapidly increased rates in 2022, with the Bank of Canada raising their target interest rate by 4.0% - the largest one year increase ever. They then raised it another 0.75% in 2023. The Bank of Canada’s target rate is currently 5.0%.

Being a predictor of the future, the bond market responded to inflation as well and bond yields rose. This pushed fixed mortgage rates higher.

Recently, the Bank of Canada has halted the rate hikes. Expectations are for rate cuts in 2024, likely in the latter half of the year. Anticipating this, bond yields had been declining until earlier this week when the reported inflation numbers were higher than anticipated.

What Have Mortgage Rates Done Recently?

Fixed mortgage rates have decline by 0.85% since their peak in October. The best five-year fixed mortgage rates are now below 5%. Lenders lower their rates as their funding costs decline. The government five-year bond represents those funding costs.

Variable mortgage rates have remained unchanged since they last went up in July 2023. Unfortunately, these variable rates do not change quickly in response to the market like fixed rates do. Variable rates will only decline once the Bank of Canada decides to lower their target rate.

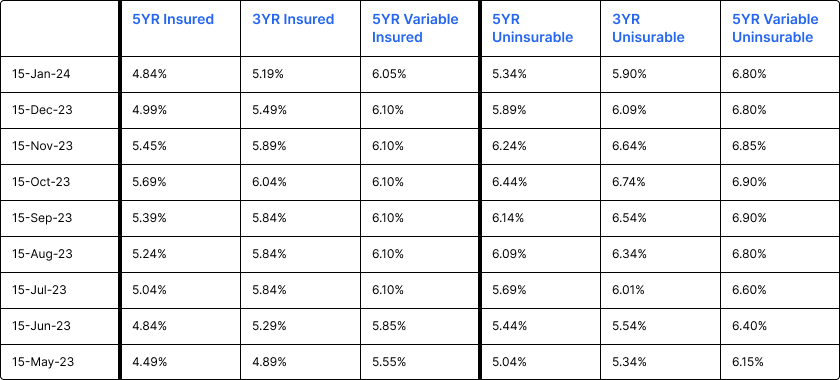

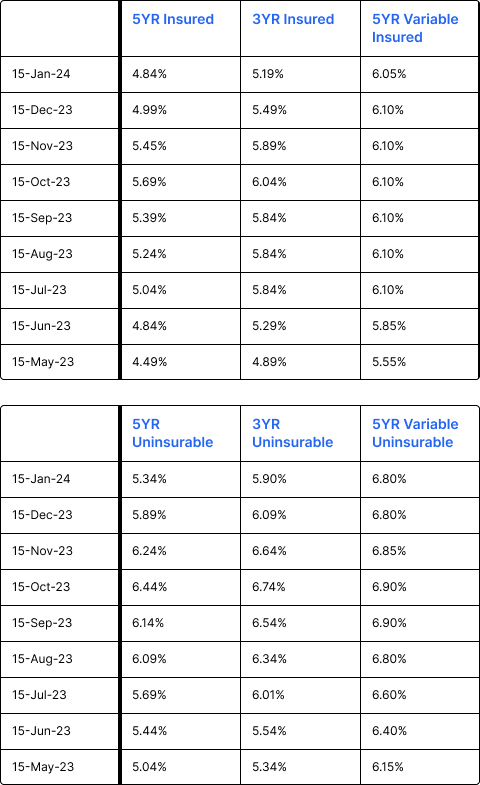

As the table below shows, fixed mortgage rates peaked in October and variable mortgage rates peaked in July. While fixed mortgage rates have declined materially, variable rates remain stuck near their recent highs.

Recent Canadian Mortgage

Will Mortgage Rates Go Down in Canada in 2024?

There are many pundits and bank analysts that are paid to make predictions. It is a difficult game, and they are wrong more often than they are right. Just look at recent year’s forecasts to see how wrong they were in 2023, 2022 and 2021. Nevertheless, their predictions are often viewed by market participants as a guide.

What are the major banks predicting the Bank of Canada will do in 2024?

The Bank of Canada is expected to start cutting rates by mid-year. The current target overnight rate of 5.0% is forecast to be lower by the end of 2024:

4.0% - RBC, Scotia & BMO

3.50% - CIBC, TD

The expectation is that the Bank of Canada will lower rates by between 1.0% and 1.5% by year-end.

While inflation remains higher than 3% the Bank of Canada will be reluctant to lower rates. The inflation data that came out on January 16, 2024, was not encouraging since inflation increased to 3.4% from 3.1% the prior month. The Bank of Canada has recently stated that there may be rate cuts in 2024 but they first need to see several months of deceleration in underlying inflation. We all wait anxiously for improving inflation numbers.

What are the major banks predicting will happen to the five-year government bond yield in 2024?

Their predictions for this are a mixed bag. The lowest predicted five-year bond yield at 2024 year-end is 2.90% and the highest is 3.50%, which is close to today’s rate. It appears that the banks think that most of the decline in the five-year bond yield has already occurred – declining from 4.42% in October 2023 to 3.54% as of January 16, 2024.

If these projections are accurate then borrowers can expect variable mortgage rates to be lower by between 1.0% and 1.5% by year end. This should provide some much-needed payment relief for many. Fixed mortgage rates may not change materially. If the banks’ projections for rates are accurate then we may see some variability up or down in fixed mortgage rates through the year with modestly lower fixed rates by year-end.

Could Mortgage Rates Increase in Canada in 2024?

If the bank analyst’s views on interest rates are accurate then an increase in mortgage rates is unlikely, although some minor movement up and down is possible with fixed mortgage rates. The risk to these forecasts is the possibility that the inflation story is not yet over. There are some concerns that core inflation remains stubbornly high, oil and gas prices could move higher and global conflict and uncertainty could put upwards pressure on inflation. Not to mention that excessive government debt is also inflationary.

The pundits completely missed the inflation story when it started to take hold in the latter half of 2021. Are they missing it again? We do not profess to know, but caution everyone to keep a close eye on inflation numbers as a guide to where interest rates may go. Hopefully, the analysts are right this time.

How Can You Stay Informed About Interest Rates?

The Bank of Canada interest rate announcements are news to keep an eye on. They make these announcements on preset dates. The schedule for 2024 is:

If you would like to keep track of the five-year government of Canada bond you can track it for free on the internet. There are many websites that let you do this, and an online search will help you find one. Here is a link to one such site - Marketwatch.com/investing/bond/5yr

For current mortgage rates in the market you can go to www.frankmortgage.com and scroll down to see our mortgage rate table that is updated daily.

You can also sign up for our monthly mortgage market update email. It provides a summary of monthly activity in the mortgage and housing markets, including an update on interest rates. You can sign up here.

Frank Mortgage's View on 2024 Mortgage Rate Predictions

We believe that the Bank of Canada will cut rates in 2024 but not by an amount significant enough to meaningfully lower overall borrowing costs.

Housing affordability will continue to be the main topic of discussion.

We are optimistic for a more active housing market in 2024 and are already seeing a pick-up in activity.

Most of the fixed mortgage rate decline that matters has already occurred as five-year fixed mortgage rates have declined by 0.85% since October. Variable mortgage rates should decline in the latter half of this year.

Fixed mortgage rates are materially lower than variable rates. The gap is now over 1%. Second-half 2024 rate cuts by the Bank of Canada may start to close that gap but rates will need to decline more significantly than projected for variable rates to make sense again.

We expect most borrowers to continue to favor fixed rates since variable rates are higher, rate uncertainty persists, and homeowners remain justifiably risk adverse.

We expect the capital markets in 2024 to be volatile. There are so many unknowns, with a housing crisis, foreign wars, a US election, ever increasing levels of government debt and general economic uncertainty. This will all affect rates and the housing market. The path to better mortgage and housing markets might be a little bumpy so borrowers should avoid taking unnecessary risks and focus on affordability and safety.

We also caution all customers to take the interest rate predictions with a grain of salt. The bank analysts that make market predictions like those noted above got it wrong in 2023, 2022 and 2021. What are the odds they get it right this year? Do your own research, seek out opposing views to get the whole picture and form you own opinions.

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts