The Prime Rate in Canada

Why Does it Matter to Mortgage Borrowers?

Canadian mortgage borrowers have experienced stress over the past year due to increasing interest rates. News headlines commonly refer to the prime rate, noting the frequent increases in the prime rate and the impact it has on variable-rate mortgage borrowers. Recently the prime rate has been declining. This is good news but, as a mortgage borrower, do you understand how the prime rate affects you?

What is the prime rate?

The prime rate in Canada as of October 23, 2024 is 5.95%.

The prime rate is most commonly defined as the interest rate commercial banks charge their most credit-worthy customers. It serves as a benchmark rate for setting the rates on a variety of financial products, including mortgages, personal loans, and lines of credit. The prime rate is influenced by a number of factors, including inflation, economic growth, and the supply and demand for credit.

The prime rate is determined by the banks themselves, and it is typically set at a level that is 1.5 to 2.5 percentage points above the overnight lending rate (aka: the Policy Rate) set by the Bank of Canada.

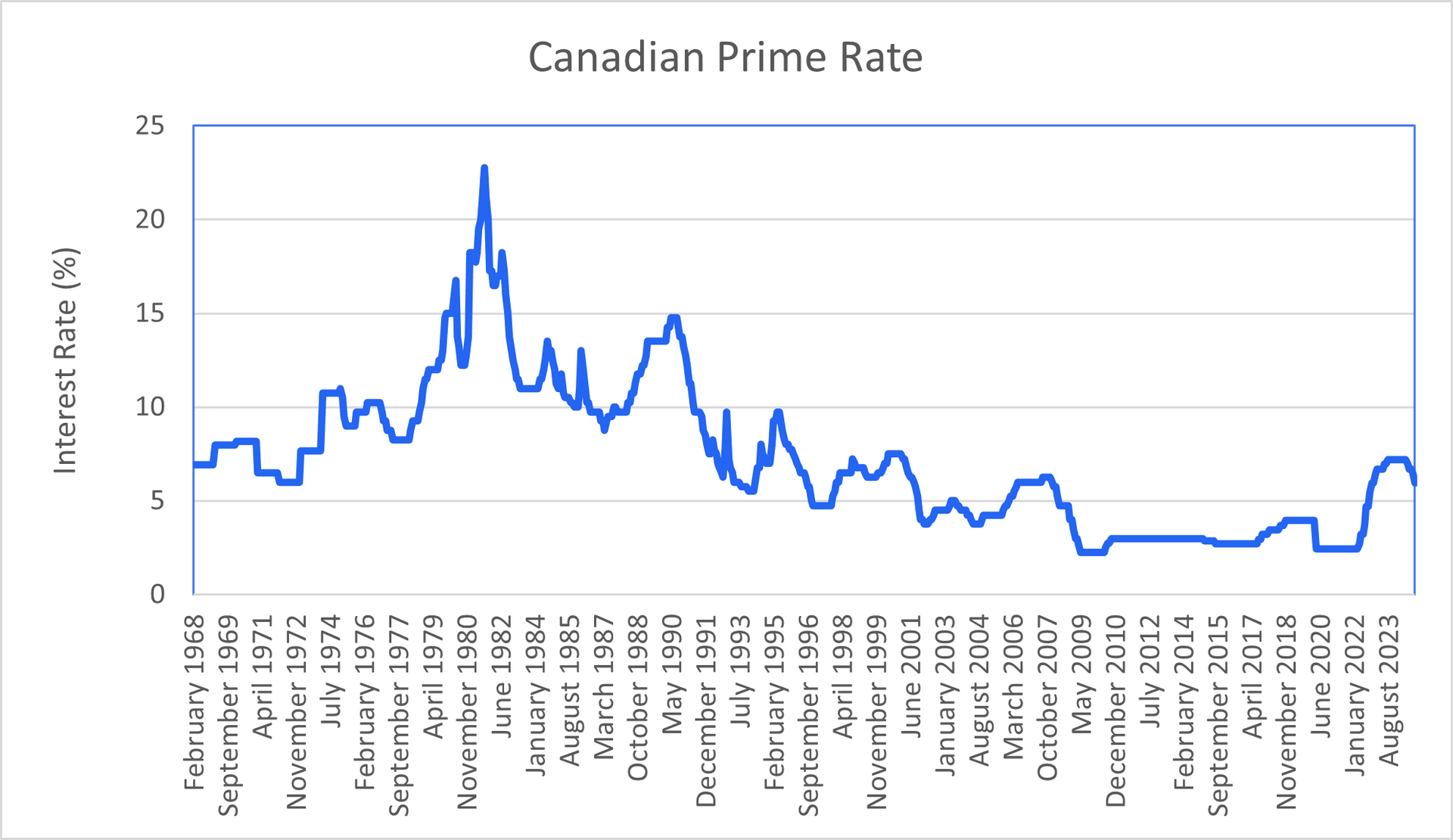

The current prime rate appears high to us today, partly due to the fact that is has been unusually low over the past decade. The average Prime Rate over the past 50 years is 7.23%, higher than today. However, the average over the past 20 years is 3.75%. Compared to more recent history, the prime rate is high at 5.95%.

How is the prime rate determined?

The Bank of Canada's monetary policy is a key determinant of the prime rate even though it does not directly set the rate. The Bank of Canada uses its benchmark overnight lending rate to regulate the nation's economic growth and restrain inflation. The Bank of Canada influences short-term interest rates by adjusting the target for the overnight rate. They make eight rate announcements each year, sometimes changing rates and sometimes keeping them unchanged. When the Bank of Canada changes their policy rate, the prime rate charged by banks changes as well. The dates when they have changed rates and the impact on the prime rate are below:

| Date | Prime Rate | Change |

|---|---|---|

| Oct 2024 | 5.95% | -0.50% |

| Sep 2024 | 6.45% | -0.25% |

| Jul 2024 | 6.70% | -0.25% |

| Jun 2024 | 6.95% | -0.25% |

| Jul 2023 | 7.20% | +0.25% |

| Jun 2023 | 6.95% | +0.25% |

| Jan 2023 | 6.70% | +0.25% |

| Dec 2022 | 6.45% | +0.50% |

| Oct 2022 | 5.95% | +0.50% |

| Sep 2022 | 5.45% | +0.75% |

| Jul 2022 | 4.70% | +1.00% |

| Jun 2022 | 3.70% | +0.50% |

| Apr 2022 | 3.20% | +0.50% |

| Mar 2022 | 2.70% | +0.25% |

| Mar 2020 | 2.45% | -0.50% |

| Mar 2020 | 2.95% | -0.50% |

| Mar 2020 | 3.45% | -0.50% |

| Oct 2018 | 3.95% | +0.25% |

There are times, such as when the Covid outbreak began, that the Bank of Canada may meet more frequently to set rates. They did so three times in March 2020.

When the Bank of Canada changes the overnight rate, the Canadian banks usually change their prime rates within a couple days. They tend to move their prime rates by the same amount and in the same direction that the Bank of Canada moves the overnight lending rate.

How to find the prime rate in Canada online

An online search of ‘prime rate in Canada’ should produce a result. Just be sure it is the current Canadian prime rate you find since the rate can change several times throughout the year. You can also find the prime rate for any particular big bank on their website. The Bank of Canada also posts daily updates for a variety of market rates, including the prime rate, here - https://www.bankofcanada.ca/rates/daily-digest/

How do banks use the prime rate?

Banks use the prime rate as a benchmark rate for a variety of financial products, including mortgages, personal loans, and lines of credit. The interest rate charged for these products is typically set at a margin above or below the prime rate. Most products will have a rate of Prime plus a margin but variable-rate mortgages for the best borrowers are usually priced at Prime minus a margin. For example, a bank might offer a variable-rate mortgage at a rate of prime minus 1% (equal to 4.95% today). As the Prime Rate moves up or down, the variable mortgage rate will move also, but the margin stays the same for the term of the mortgage.

How are variable mortgage rates set relative to the prime rate?

Variable rate mortgages are directly tied to the prime rate. When the prime rate goes up, so does the interest rate on a variable rate mortgage. Conversely, when the prime rate goes down, so does the interest rate on a variable rate mortgage. This means that borrowers with variable rate mortgages are exposed to interest rate risk, as the cost of their mortgage will increase if the prime rate increases.

The margin relative to the prime rate depends on market conditions, the risk profile of the borrower and the costs of lending. When market conditions are positive, the margin for the best borrowers can be as much as minus 1.50%. When market conditions worsen, that margin can be as small as 0.25% to 0.50%.

The prime rate is usually the same for all banks. They will use their prime rate for pricing variable rate mortgages and the competitive difference in rate between the banks is the margin below the prime rate that they offer. However, there is one bank that does things differently. TD Bank uses a prime rate for mortgage lending that is equal to their prime rate plus 0.15%. They have been doing this since 2016. Borrowers should note this since TD needs to offer a larger margin discount to their prime rate to get you to the same rate being offered by other lenders.

| Rate | Target Overnight Rate | Prime Rate | Variable Mortgage Rates |

| Who Decides | Bank of Canada | Banks | Banks & other lenders |

| Current Rate | 3.75% | 5.95% | Between 4.95% and 7% |

What is the historic margin between variable mortgage rates and the Prime Rate?

The historic margin between variable mortgage rates and the prime rate has varied over time. In general, the margin tends to be a discount ranging between 0.25% and 1.5%, depending on market conditions and the risk profile of the borrower. During times of economic uncertainty or when credit conditions are tight, banks may offer less of a discount margin to account for increased risk.

For those of you that are looking to get a Heloc, you should note that the rate for a Heloc will be higher than for a variable-rate mortgage. Helocs carry an interest rate that is usually prime plus a margin. This margin can range between 0.50% and 3.0% at the banks.

Can anyone predict where the prime rate will go in the future?

Predicting where the prime rate will go in the future is difficult. It is influenced by a wide range of factors and, as we saw in 2022, can be subject to sudden changes. Some economists and analysts use models to make forecasts projecting the future direction of interest rates, but these projections are often imprecise and subject to error. Ultimately, the direction of the prime rate will depend on a variety of economic factors that influence the rate setting policy of the Bank of Canada, including inflation, economic growth, and the supply and demand for credit.

Most Recent Bank of Canada Rate News

The Bank of Canada cut their benchmark interest rate a further 0.50% on October 23. This is the fourth consecutive cut, bringing the benchmark rate down to 3.75%, from its high earlier this year of 5.0%

A 0.50% rate cut is a significant signal to the market and follows on the 0.50% rate cut by the US Federal Reserve. Central banks are clearly comfortable that inflation is now under control and they are attempting to stimulate the economy to avoid recession.

The 1.25% cumulative decline in the benchmark Bank of Canada rate since June means a 1.25% decline in variable mortgage rates. This represents monthly payment savings for variable-rate mortgage holders of close to $70 for every $100,000 of mortgage. For new homebuyers these lower variable rates create close to 10% in added buying power.

Despite these rate cuts, variable mortgage rates remain higher than fixed mortgage rates - the best variable mortgage rates will now be in the high 4% range while the best fixed rates are in the low 4% range. Additional rate cuts are anticipated, which could soon lead to a more typical rate environment where variable rates are below fixed rates.

We do not expect variable mortgage rates to return to the lows seen a couple years ago (remember when they were 0.99%?). Several banks now expect the Bank of Canada to reduce their benchmark rate to 2.25% by the end of 2025. This would bring the lowest variable mortgage rates into the mid-3% range.

Fixed mortgage rates have also dropped since the Bank of Canada began cutting rates in June, though not as significantly. Recently they have levelled off and are not declining in response to today's Bank of Canada rate cut. They are down about 0.60% since the first rate cut in June, compared to 1.25% for variable rates. This shows that the Bank of Canada rate cuts impact variable rates more than fixed rates. Some bank analysts have estimated that fixed rates are unlikely to decline by more than 0.50% in the next year, if at all. When evaluating your mortgage needs, you should weigh the possibility that fixed mortgage rates may not decline much further.

In their accompanying statement the Bank of Canada stated that "With inflation now back around the 2% target, Governing Council decided to reduce the policy rate by 50 basis points to support economic growth and keep inflation close to the middle of the 1% to 3% range. If the economy evolves broadly in line with our latest forecast, we expect to reduce the policy rate further."

They also stated that "The Bank’s preferred measures of core inflation are now below 2½%. With inflationary pressures no longer broad-based, business and consumer inflation expectations have largely normalized.."

Inflation has been steadily declining, falling below the 2% target rate in September to 1.6%. The cumulative effect of these four consecutive rate cuts is now material and improves affordability for mortgage borrowers. While some may wait for more cuts, we are seeing an increase in activity in the housing and mortgage markets. If you want to explore what the current buyer's market in housing and improving mortgage affordability might mean for you, now is the time to reach out to us at Frank Mortgage to see what is possible. Please click below to search for rates or to arrange to speak with us.

The prime rate at the banks will now decline from the current 6.45% to 5.95%.

You can read the Bank of Canada's full press release here - Bank of Canada reduces policy rate by 50 basis points to 3¾% - Bank of Canada

There is one more Bank of Canada rate announcement scheduled in 2024, on December 11.

Conclusion

The Canadian bank prime rate plays an important role in the country's financial system, serving as a benchmark rate for a variety of financial products. While the Bank of Canada does not directly set the prime rate, it does have an indirect influence on it through its monetary policy. Banks use the prime rate as a basis for setting interest rates on loans and lines of credit, and borrowers with these variable-rate products, such as variable-rate mortgages, are exposed to interest rate risk. While predicting the future direction of the prime rate is difficult, understanding how it is determined and how it is used by banks and borrowers can help individuals make informed financial decisions.

If you have a variable rate mortgage you need to be aware that rates may increase. However, market expectations are that rates will continue to come down in 2024. This does appear likely but be careful not to put too much weight on these predictions. They have been wrong in the recent past. If you are risk-averse, manage your own affairs without trying to guess where rates are going. Variable-rate mortgages contain risk and are not for everyone. If you are certain in your belief that rates are coming down then a variable-rate mortgage might make sense, but understand that variable rates are materially higher than fixed rates today so that rate decline needs to be significant for you to benefit.

If you are in the market currently for a mortgage, a fixed rate might be the best solution. Perhaps even a short-term fixed-rate mortgage. With no exposure to interest rate risk during the term of the mortgage, a fixed-rate mortgage is the conservative choice for the majority of us that have a low risk tolerance.

To find great low rates, please click below.

You can also find us at www.frankmortgage.com or at 1-888-850-1337

When the bank of Canada increases or decreases their overnight target borrowing rate, the banks will usually change their prime rate by the same amount within a couple days.

The prime rate does not directly affect fixed mortgage rates. It does affect variable mortgage rates. Most mortgage lenders set their variable mortgage rates at a margin versus the prime rate. This can be either a premium or discount to the prime rate. For example, for a prime, closed variable rate mortgage you might see the rate quoted at prime minus x%. For a heloc you may see a rate of prime plus x%.

All the major banks set their own prime rate. They tend to be the same over time among all the banks. However, for pricing mortgages, TD Bank has a prime rate 0.15% higher than the other banks. Non-bank mortgage lenders will price their variable-rate mortgages using the prime rate from their chosen bank.

Also referred to as the Bank of Canada’s policy rate, this is the benchmark cost of

borrowing set by the Bank of Canada. It is the rate at which Canada’s banks can borrow

money from each other or from the Bank of Canada on an overnight basis. The BoC updates

the rate periodically throughout the year. This rate is the main tool used by the BoC to

set monetary policy. They adjust the rate to regulate the cost of borrowing and demand

for investment and this can be used to control inflation and economic activity.

When the updates are done, change the date on the blog but instead of just showing the

date please say “Updated April 10, 2024”.

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts