Gross Debt Service (GDS) Ratio and Total Debt Service (TDS) Ratio

What Are They and How Do They Impact My Mortgage Application?

When evaluating a mortgage application, a mortgage lender needs to understand how much of the applicant’s monthly income will be required to cover the mortgage and other debts. The lender will calculate two key debt ratios that can make or break your mortgage application. They are the Gross Debt Service (GDS) Ratio and the Total Debt Service (TDS) ratio. If you need help understanding what these ratios mean for your mortgage application, read on!

One thing to clarify first – the mortgage payment used to calculate the debt service ratios is based on the stress tested mortgage rate. The lender is required to use the rate on your mortgage plus 2%. They calculate a mortgage payment using that stressed rate and that is the mortgage payment used when calculating the GDS and TDS ratios.

Another thing to note is that the debt ratios discussed in this blog are for mortgage applications for a primary residence. The acceptable ratios for a rental property would be lower.

What is the GDS Ratio?

GDS ratio is a measure of the proportion of your gross monthly income that is required to cover your monthly housing costs. The formula used is:

mortgage payment + property taxes + heating + 50% of condo fees (if applicable) / gross household income

Mortgage lenders cap the GDS ratio at 39% for prime mortgage borrowers. If your credit score is below 680, but above 620, some lenders will reduce the maximum GDS ratio to 35%.

What is the TDS ratio?

The TDS ratio is a measure of the proportion of your gross monthly income that is required to cover your monthly housing costs plus other monthly debt payments, which include car loans, student loans, credit cards and other debts. The formula used is:

mortgage payment + property taxes + heating + 50% of condo fees (if applicable) + other debt payment obligations / gross household income.

If you do not have any other outstanding debts, your GDS and TDS ratios will be the same.

Mortgage lenders cap the TDS ratio at 44% for prime mortgage borrowers. If your credit score is below 680, but above 620, some lenders will reduce the maximum TDS ratio to 42%.

You will need to know your mortgage payment to determine your debt ratios. To get an estimate of your mortgage payment you can use this mortgage calculator.

What Income Amounts can be Included in the Debt Ratio Calculations?

Mortgage lenders will review your income sources to determine what can be included in the debt ratio calculations. Provable income is important and you will need to provide documentation to support your income. The income sources that can be used include:

- Employment income;

- Any non salary, variable income. Lenders will want to see a two-year history of this income. It can include, commission, bonus, overtime, investment, self-employed and part-time income where the hours are not guaranteed;

- Rental income; and

- Pension Income

Lenders will not include EI income or most kinds of social assistance payments in the calculations.

Why are GDS and TDS Ratios Important for Mortgage Applications?

GDS and TDS are important factors in mortgage applications because lenders want to make sure your income will be enough to cover your debt obligations. In combination with your credit score and the stability and amount of your income, the lenders use the GDS and TDS ratios to make an assessment of the likelihood that you can make the mortgage payments over time.

If you have a GDS ratio less than 39% and a TDS ratio less than 44% you may be able to qualify for the lowest available mortgage rates. To find out how to qualify for the lowest rates please see here.

If your ratios are above these limits, then you might still be able to qualify for a mortgage with a higher rate. This would be either an alternative product from an A lender or a mortgage from a B lender.

Otherwise, if your ratios are high, you may want to wait until your financial situation improves before applying for a mortgage.

What Can You do if Your Debt Ratios are Too High?

If your GDS ratio is too high, you can lower the ratio by increasing your down payment. The higher down payment results in a smaller mortgage which reduces the monthly mortgage payment. If you are unable to lower the GDS ratio this way, you may have to find a non-prime mortgage.

If your TDS ratio is too high, the best remedy is to pay down some of the other debts that you have. Eliminating some of those debt balances will reduce the payment amounts for those debt obligations that are used in the TDS calculation. If you cannot bring your TDS ratio below 44% then you may have to find a non-prime mortgage.

If your debt ratios are too high, possible solutions include:

- Providing a higher down payment – can fix a high GDS or TDS ratio;

- Pay down some existing other debts – can fix the TDS ratio;

- Find a co-borrower or co-signor. If they have good income and low debt, they can be used in combination with you to improve the overall debt ratios for the mortgage application;

- Reduce your budget by finding a less expensive home that requires a smaller mortgage; or

- Find a non-prime mortgage product that will carry a higher interest rate. Non-prime lenders can consider a mortgage application where the GDS and TDS ratios are higher than 39% and 44%, respectively.

Be Proactive with Your Mortgage Application

Don’t wait until you are well into the mortgage process to understand your debt ratios.

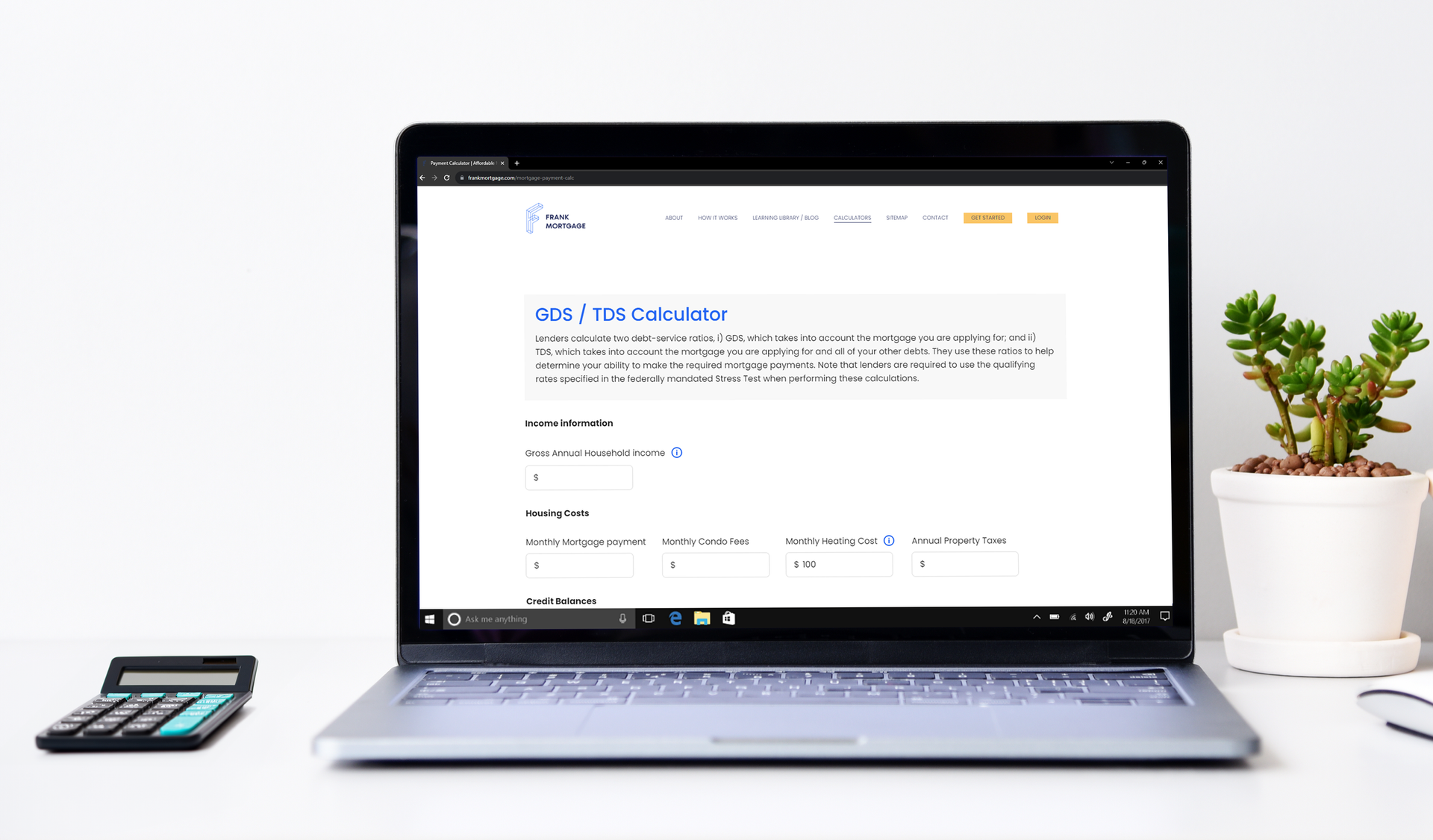

If you like doing your own independent analysis, you can calculate your GDS and TDS ratios using our easy online calculator here - GDS / TDS Calculator | Frank Mortgage

If you want some live help with you mortgage needs, please call us at 1-888-850-1337. You can also find us at www.frankmortgage.com, where you can book a free consultation with an advisor. It is never too early to talk about what you need to do to qualify for a mortgage. It is best to find out ahead of time if you need to save more for a larger down payment or pay down some existing debts in order to get your debt ratios in line with lender requirements.

If you are ready to start your mortgage journey then join the flow of customers moving away from the old, traditional way of getting a mortgage. Frank Mortgage is the future, where getting your online mortgage has never been easier.

Related Pages

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts