Mortgage Default Insurance

Helping Canadians Finance Their Homes

Yes, in Canada, you need to have a down payment to purchase a house. Lenders require you to have some ‘skin-in-the-game’ in the form of a down payment.

To get a conventional mortgage you need a down payment of 20%, meaning that 20% of the properties value must be covered by you via your down payment. The lender can then finance up to 80%.

A 20% down payment is a significant sum. Fortunately, for most of you just starting out on your journey to acquire a home and establish a financial base, there is mortgage default insurance. With mortgage default insurance in place, it is possible to obtain a mortgage on your home with a down payment as small as 5% of the property’s value.

What is Mortgage Default Insurance?

Mortgage default insurance is an insurance policy that protects your mortgage lender against loss if you default on your mortgage. If a lender is unable to recover the remaining amount of a mortgage owing to them after a borrower has defaulted, the insurance covers the shortfall or loss.

Mortgage default insurance is important to the functioning of the Canadian mortgage market. Any mortgage with a loan-to-value (LTV) ratio above 80% that is originated or funded by a federally regulated financial institution must be covered by mortgage default insurance. The LTV ratio is the mortgage balance divided by the property value.

Note that mortgage default insurance does not provide protection for borrowers. This does not mean the borrowers don’t benefit. It would be difficult to find a mortgage in Canada without a 20% downpayment if it wasn’t for mortgage default insurance.

What is the Required Down Payment?

The minimum required down payment is 5% for a home with a purchase price of $500,000 or less. When the purchase price is above $500,000, the required down payment is 5% for the first $500,000 and 10% for the remaining balance, provided the purchase price/value of the property is less than $1,000,000.

- Properties worth more than $1,000,000 are not eligible for mortgage default insurance and the required down payment is 20%.

Who Provides Mortgage Default Insurance?

The Canada Mortgage and Housing Corporation (CMHC) is the main provider of mortgage default insurance and the key driver of this segment of the market. CMHC is a crown corporation and sets the rules. There are two other significant providers, Sagen (previously called Genworth Financial) and Canada Guaranty, that are both private companies.

Recent changes to the Government of Canada’s appetite for housing risk has led to CMHC taking a declining share of the market, to the benefit of Sagen and Canada Guaranty. These two companies have their own underwriting policies and there are some differences between them, but most borrowers won’t notice the differences. Suffice to say, if your down payment is less than 20%, you should be happy to obtain mortgage default insurance from any of these three insurance providers.

How Do You Qualify for Mortgage Default Insurance?

While every lender and every insurer in the market crafts their own underwriting criteria, the criteria are generally very homogenous. Some differences exist, but for most material underwriting policy criteria, they are all the same. The lenders consider the underwriting criteria of the insurers when they create their own underwriting policies. They may at times be stricter than the insurers and other times may have products that are 100% in line with insurer criteria.

When you apply for a mortgage with a down payment of less than 20%, you don’t interact with the insurer. The lender does the work – they are the beneficiaries of these insurance policies after all. The lender will underwrite your mortgage application with their requirements and the requirements of the insurer considered. The lender submits an application to the insurer as part of their underwriting process and receives confirmation back from the insurer if the application is approved.

What are the Key Criteria?

To qualify for mortgage default insurance with CMHC, you’ll need to meet these criteria:

- The value of the property being financed must be less than $1,000,000,

- The amortization period must be no greater than 25 years,

- Your gross debt service (GDS) ratio cannot be greater than 39%,

- Your total debt service (TDS) ratio cannot be greater than 44%,

- Investment properties are ineligible,

- At least one borrower must have a minimum credit score of 600,

- Your down payment must come from your own funds. In other words, if you borrow the money for your down payment, you won’t qualify for a CMHC-insured mortgage.

Note that at Sagen and Canada Guarantee some of these criteria may differ. For instance, these private insurers may offer programs for borrowed down payments or insurance for investment properties, although some restrictions apply.

Who Pays and What Does Mortgage Default Insurance Cost?

To obtain mortgage default insurance a lender must pay a premium to the insurer. If you have a high-ratio mortgage that requires insurance, the cost of that insurance premium is passed on to you. In other words, if you want a mortgage when you have less than a 20% down payment, you pay for the insurance.

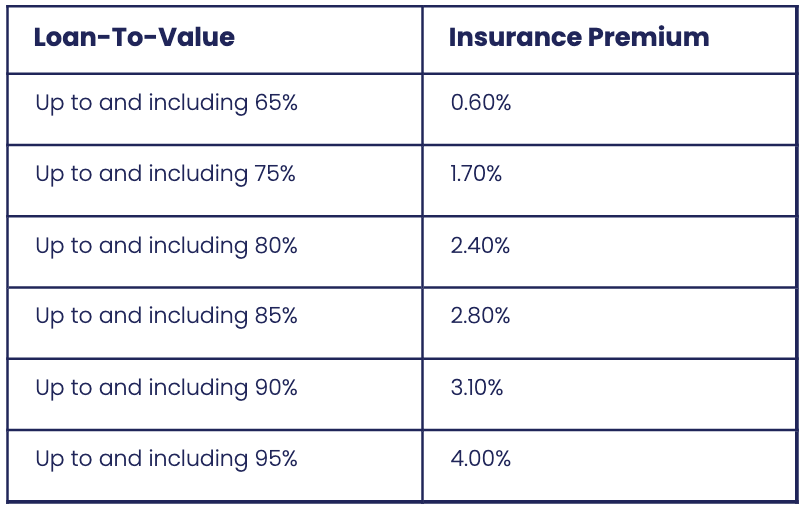

Most of the time the amount of the insurance premium is added to the mortgage balance. When doing this you are effectively borrowing the funds for the premium at the mortgage rate and paying it back over time. The alternative to that is to pay the entire premium at the closing of the mortgage but that may not be desirable because the premiums can be large. The premium for mortgage default insurance is based on the size of the mortgage and the LTV. The larger the down payment you provide, the lower the LTV and the lower the premium. The premiums, calculated as a percentage of the principal balance of the mortgage, are shown on CMHC’s website as follows:

Note that some special programs may incur higher premiums.

The premium amount is calculated as the applicable percentage from the table above multiplied by the mortgage balance. For example, if you have a $400,000 mortgage with a 5% down payment (i.e.. a 95% LTV) then the premium is 4% x $400,000 = $16,000. This is a material sum, and you can see why most borrowers prefer to include it in the mortgage balance rather than pay it upfront.

If you would like to test different scenarios for mortgage default insurance, follow this link to get access to Frank Mortgage’s Mortgage Insurance Calculator - https://www.frankmortgage.com/mortgage-insurance-calculator

You may have noticed that there are insurance premiums for mortgages with LTVs less than 80% in the table above. If your mortgage has an LTV less than 80%, mortgage default insurance is typically not required. However, there are some instances when a buyer with a down payment of more than 20% is required to pay for the insurance. Examples are if the property is in a remote area or a community with just one industry.

The lender may also choose to have a conventional mortgage insured for their own risk management purposes. Lenders refer to such a mortgage as an ‘insurable mortgage’. If a lender does this with a less than 80% LTV mortgage it does not affect the borrower. The lender pays the mortgage default insurance premium and does not pass it on to the borrower.

One last thing to note about pricing is that if you purchase an energy-efficient home or make energy-saving renovations, you could be eligible for a 10% refund on your mortgage insurance premium. For more information, please visit the mortgage default insurers' websites.

PST On Mortgage Default Insurance

Mortgage default insurance premiums in Saskatchewan, Ontario and Quebec are subject to provincial sales tax (PST). The PST must be paid by the borrower at closing because it cannot be added to the mortgage balance. Borrowers in these three Provinces need to take this into account when estimating their mortgage closing costs.

Mortgage Default Insurance Helps New Home Buyers

While there is a substantial cost to mortgage default insurance, the benefits to both borrowers and lenders are significant. Lenders are provided with protection against riskier mortgages with low down payments. Borrowers are able to purchase a home with a down payment as small as 5%. This allows new home buyers to acquire a home and begin building equity sooner.

If you have any questions about mortgage default insurance, our team at Frank Mortgage is always here to help. Simply call us at 1-888-850-1337 or go to www.frankmortgage.com and open an online chat to talk to someone live.

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts