The Revised Stress Test: An Introduction

The stress test is something mortgage seekers dread as much as the gym class version of it we all had to endure in high school. The first step to overcoming a fear? Understanding it. So let’s dive into everything you need to know about the mortgage stress test and the changes implemented by the Office of the Superintendent of Financial Institutions (OSFI) on June 1st 2021.

What Is A Stress Test?

Let’s start by answering the most important question. What exactly is a stress test? Federal regulators have imposed new requirements on the mortgage lending industry in recent years. This includes the need for prospective Borrowers to pass a stress test to qualify for a Mortgage with a Federally Regulated Financial Institution.

The stress test requires you to prove you can afford payments at a qualifying interest rate which is typically higher than the actual rate on your mortgage. The qualifying interest rate your lender is required to use for the stress test depends on whether you need to get Mortgage Default Insurance.

Credit unions and other lenders that are not federally regulated do not need to use this mortgage stress test but because many depend somewhat on banks for their own financing, most (but not all) have adopted the stress test.

Recent Changes to the Mortgage Stress Test Rate

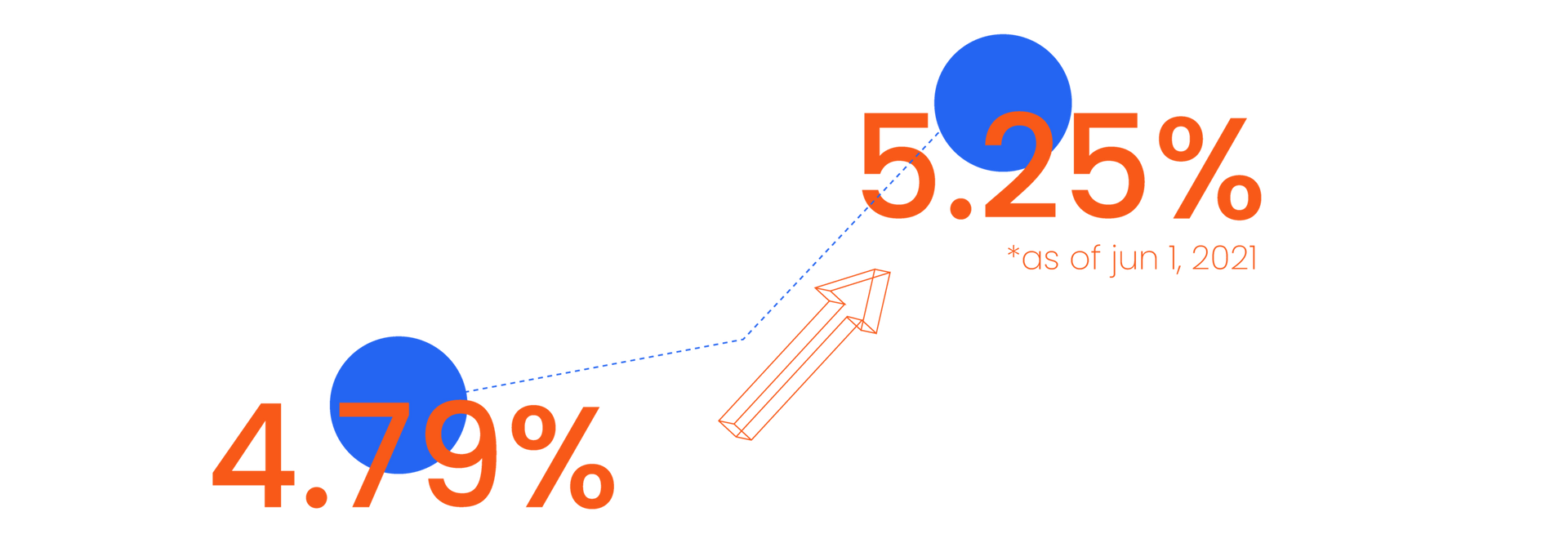

The current mortgage stress test rate of 4.79% was increased to 5.25% on June 1, 2021.

In 2018, OSFI introduced new mortgage underwriting rules, including the mortgage stress test. At the time OSFI stated that the new rules “reinforce a strong and prudent regulatory regime for residential mortgage underwriting in Canada”. OSFI has enforced new rules in recent years to address identified risks primarily related to underwriting quality and household leverage.

The stress test looks a little bit different depending on how much of a downpayment you are planning to put down. To qualify for a residential mortgage from a Canadian financial institution you will be subject to this stress test:

1. If your down payment is 20% or more (ie. you are getting a conventional mortgage), the lender will qualify you using the higher of:

- the rate on the mortgage being offered to you plus 2%; and

- the Qualify Rate of 5.25%

2. If your down payment is less than 20% (ie. you are getting a high-ratio mortgage), the lender will qualify you using the higher of:

- the rate on the mortgage being offered to you; and

- the Qualify Rate of 5.25%

What Does This Mean for Prospective Home Buyers?

If we compare the 5.25% qualifying rate to the lowest market rates, at the time of this writing (1.69% for a fixed rate mortgage and 1.20% for a variable rate mortgage) it is over 4x the variable rate! The higher interest rates used in the stress test make it more difficult to qualify for a mortgage and reduce the house price you can afford to pay. If using the 5.25% qualifying rate, the revised stress test reduces your purchasing power by over 30%. This most recent change from 4.79% to 5.25% alone may reduce your purchasing power by approximately 4.5%.

OSFI’s stated concerns that gave rise to the stress test are that interest rates remain at historically low levels and personal debt levels remain historically high. They believe that, given these conditions, a margin of safety is prudent.

Expect The Unexpected

The practical reality of the stress test is that it is only necessary because we are in a period of extended, and, some would argue, artificially low interest rates. Now that we are emerging from COVID-19 lockdowns, authorities see a rise in economic activity potentially generating higher interest rates. The increase of the stress test qualifying rate to 5.25% is their response.

This may seem prudent given the intention of the stress test, but the impact is disproportionately negative for those on the cusp of pursuing their home ownership dreams. For some, qualification is now not possible. For others, they are forced to downsize their expectations to a smaller, less expensive home or will be forced to take higher rate mortgages than they would have to otherwise. Seems ironic doesn’t it? Authorities forcing an extended period of low interest rates upon the market in the name of helping the average Canadian creates risk, leading to the same authorities introducing measures that negatively affect the average Canadian to counteract that risk.

Nevertheless, all new home buyers need to be prepared to pass the stress test when applying for a mortgage. You need to evaluate your finances before deciding to purchase a home and Frank Mortgage can help. Frank automatically calculates your mortgage eligibility including the stress test to make it easy for you to determine what you can afford. Knowing this up front can prepare you for success in your search for a home. Do you have any questions about the stress test? Let us know in the comments below! We’ve got your back.

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts