TO BUY OR NOT TO BUY

Should you buy a new home today before interest rates rise further or should you wait in anticipation of a decline in house prices?

After settling into an extended period of low interest rates that fueled a significant increase in housing prices in Canada, market participants are now bracing for change. Interest rates are increasing. The Bank of Canada has stated that additional interest rate hikes are on the way. Fixed interest rates in the bond market have increased in response to the recent inflation pressures and central bank action. The five-year Canada yield has increased 1.25% since February. The housing market responded quickly and is showing signs of softening. Some realtors report that their buying clients are sitting on the sidelines expecting prices to drop. This is understandable. Homebuyers and investors have become accustomed to low rates and the sudden change in direction of interest rates has altered market sentiment almost overnight.

Should I Buy a New House Now?

With this shift in market sentiment, many homebuyers are asking themselves two questions:

- should I buy now to lock in a mortgage rate before rates increase further, or

- should I wait and see if house prices drop further to get a better deal.

If housing prices decline in the coming weeks or months, a buyer can benefit if they wait for lower prices. If interest rates continue to rise, however, waiting can also reduce their borrowing power. What is the best thing to do? Wait for a price drop? Or, lock-in a new mortgage rate today?

Increasing Mortgage Rates

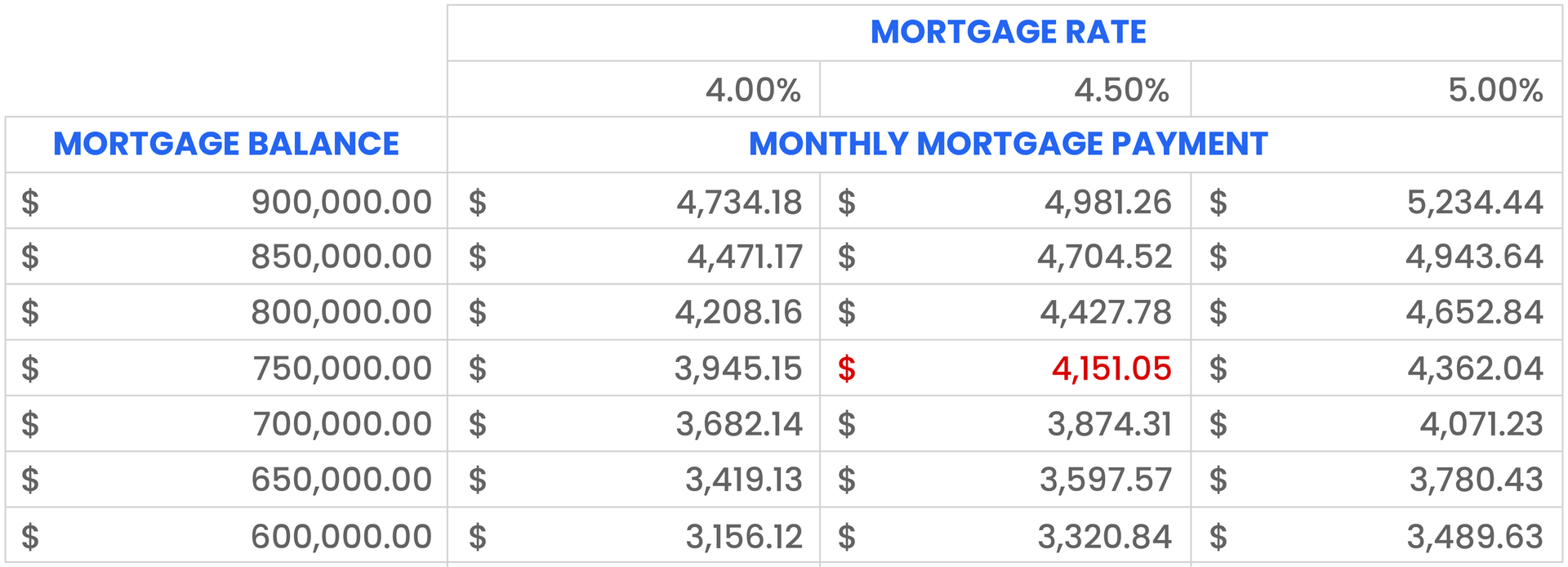

The following table shows the impact on a monthly mortgage payment for both different interest rates and housing prices.

According to the CREA, the average house price in Canada is $746,146. We have used $750,000 as a base case for this data. An increase of 50 bps from 4.50% to 5.00% increases the monthly payment on the average Canadian house from $4,151.05 to $4,362.04. That is a monthly increase of $210.99. This equates to over $12,600 in additional payments over the course of a five-year mortgage.

This increase in monthly payment adds up over time. Note that many market pundits are suggesting the Bank of Canada could raise rates a further 1.25% or more. If fixed mortgage rates increase by a similar amount, from 4.50% to 5.75%, the incremental payments on a mortgage with the higher 5.75% rate over the term of the five-year mortgage could be as much as $31,500. You can lock-in a lower mortgage rate today to avoid this outcome.

Borrower Purchasing Power

The decision on whether to buy now or wait, however, is not as simple as looking at potential house price declines versus incremental mortgage payments at higher rates. The impact of potentially higher rates on your borrowing power, which declines as rates increase, is a key consideration.

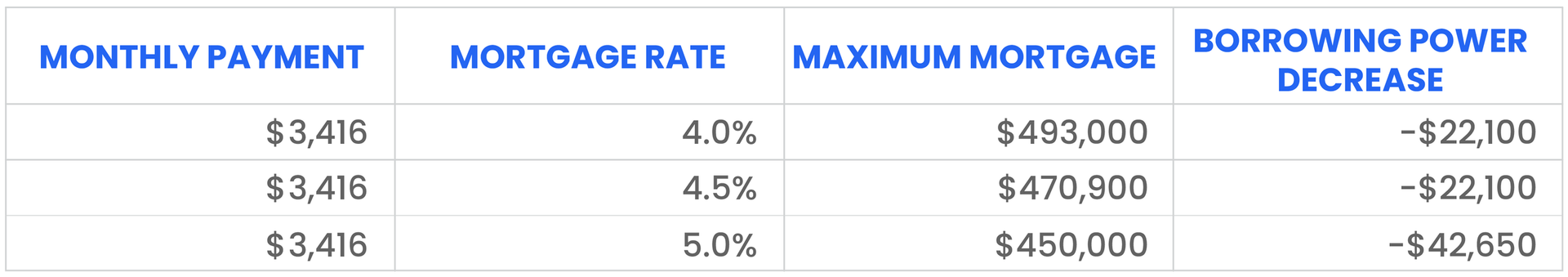

Consider the following scenario: a mortgage applicant with a family income of $120,000 per year and minor other debts. Such an applicant may qualify for a mortgage with a monthly payment of $3,416 using today's mortgage stress test criteria. This would allow them to take on a maximum mortgage amount of about $493,000 if the mortgage rate was 4.0%.

The table below shows the impact on borrowing power if mortgage rates increase.

Note that these numbers incorporate the Canadian Mortgage Stress Test. For example, the 4% fixed mortgage rate scenario uses a Stress Test rate of 6% (mortgage rate plus 2%) to determine the maximum mortgage amount that a borrower with $120,000 of income can qualify for.

A 1% increase in the fixed mortgage rate, from 4.0% to 5.0%, reduces borrowing power by $42,650.

With a mortgage of $493,000, the borrower could consider paying close to $520,000 for a house (the math here factors in the addition of the mortgage insurance premium to the mortgage balance). A 1% increase in rates, would need to be offset by a greater than 8% decrease in housing prices, for the borrower to be able to purchase the same home ($42,650/$520,000).

Not every real estate market in Canada will react the same way, but many markets in Canada are showing signs that house prices have declined in recent weeks. It is possible that house prices decline by 8% or more in many markets, especially if interest rates continue to rise. But the waiting game is not all positive. You might catch a better price in a falling housing market, but your borrowing power will decline as rates continue to rise. If mortgage rates increased another 1%, the typical buyer described above would need to look at homes that cost about $42,000 less. Depending on where you are, you may not see a house price decline that significant.

Get a Mortgage Pre-Approval Today

The decision to wait for housing prices to move lower, versus the need to lock-in a rate today is personal. Pundits predicting the direction of interest rates and/or the direction of housing prices face no negative consequences if they are wrong. Those consequences are yours to bear. While it is difficult to predict where house prices will go, if you are thinking of entering the market now it does appear that bidding wars are largely behind us, except for in some urban centres, and some of the market froth has subsided. Perhaps you can get a pre-approval or a rate-hold from a lender and look for your dream home today without needing to worry about bidding wars. Depending on your location you may even find a better deal in May/June than you could have found back in February.

If you anticipate purchasing this spring or summer, lock-in a rate with a pre-approval or a rate-hold now. Shop for a house knowing that you have a rate you can afford and are protected against short-term increases in mortgage rates.

For a quick, online pre-approval process, please got to www.frankmortgage.com.

Helpful Mortgage Calculators

Want to find an easy way to calculate your mortgage borrowing power? At frankmortgage.com you can also check out how much you may be able to afford today using our mortgage affordability calculator - Mortgage Affordability Calculator | Frankmortgage.com.

You can also test various mortgage payment scenarios to see what the cost of different mortgages may be to you by clicking this link -

Payment Calculator | Affordable Mortgage Loans Canada | Frankmortgage.com

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts