Why did Variable Rate Mortgages become so popular?

How did so many Canadians end up getting variable-rate mortgages just before rates began to rise? Historically, the Canadian mortgage market has been predominantly a fixed rate mortgage market. Thirty percent or less of new annual mortgage volumes tended to be variable rate mortgages.

Perhaps when we consider investments in stocks or crypto we may want to make risky bets from time-to-time. When we are talking about our homes, we tend to be more conservative. Your home is the place you plan to raise a family, share your life with your partner, find shelter from the storm. Most of us are reluctant to place bets on our homes, preferring to avoid risks we can’t control that may affect our ability to maintain our home. Peace of mind is important, as reflected in the historical preference for fixed rates.

The Canadian Mortgage Market Has Changed Recently

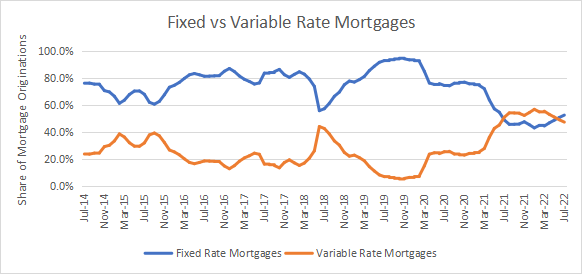

The fixed vs variable rate mortgage volume graph below shows that fixed rate mortgages have been more common than variable rate mortgages. Recently that changed as the percentage of mortgage borrowers seeking variable rates recently increased to unprecedented levels, rising above 50% of the market.

It is a peculiar outcome when you consider that it began when rates were at historic lows in 2021. A borrower could have taken a fixed rate mortgage at or below 2% in 2021. Prior to June 2020, fixed mortgage rates had never been below 2%. Although this low-rate environment should have encouraged borrowers to take fixed-rate mortgages, more borrowers opted for variable rate mortgages than ever before. It is likely that every one of those borrowers regrets not locking in a 2% fixed rate mortgage, a rate which seems magical today.

Why Did Variable Rate Mortgages Become So Popular?

This is a complicated issue with many factors at play but there are three things that stand out to us at Frank Mortgage:

- We were all led astray by our central bank. Take what the Governor of the Bank of Canada said in July 2020:

“Our message to Canadians is that interest rates are very low and they’re going to be there for a long time. ”He went even further and said, “If you’ve got a mortgage or if you’re considering making a major purchase, or you’re a business and you’re considering making an investment, you can be confident rates will be low for a long time.”

Then in November 2020 in testimony before the House of Commons Standing Committee on Finance – he said: “We want to be very clear, Canadians can be confident that borrowing costs are going to remain very low for a long time.” He clarified his thoughts on timing by adding that interest rates are projected to remain low until 2023.

Confident that rates would stay low for a long time and lulled into a sense of complacency regarding the risk, many Canadians levered up (i.e., borrowed money) so they could participate in the rising housing market. The fear of missing out is not a helpful emotion when making financial decisions. Then, suddenly, after the Bank of Canada realized they underestimated the threat of inflation, they dramatically changed course. They have raised short-term interest rates by three percent so far in 2022, with further increases expected. It is hard to be generous with an assessment of the Bank of Canada’s actions. They encouraged average Canadians to maximize their borrowing at historically low rates and then raised rates on them once they had done so. Quite the rug pull! - Market participants promoted financial advantage at the expense of risk management. Market sentiment was bullish, encouraged by low interest rates. Advisors and mortgage brokers were pushing variable rate mortgages, suggesting that since variable mortgage rates were lower than fixed mortgage rates, they were the best option. What a mistake! The risks inherent in variable rate mortgages that Canadians have historically tended to avoid were being ignored.

The mindset that real estate prices always go up and low interest rates were the new normal was promoted by many advisors from late 2020 into early 2022. Neither of these assertions are ever true.

One key thing that this mindset obscured was that the interest rate environment that existed recently was an anomaly.

The chart above shows that the post financial crisis period since 2010 produced abnormally low interest rates. Not only that, but rates were held within a tight band for an unusually long time. The recent rise in interest rates, while sudden and rapid, has returned the prime rate to more normal historical levels. In fact, today’s Prime Rate of 5.45% is below the average rate experienced since 1960 of 7.05%. Today’s rates may seem high, but they are closer to the norm than the rates of the past decade.

Canadians tend to be conservative, historically preferring fixed rates and avoiding interest rate risk. Not embedding interest rate risk into your home financing fits with a conservative view of risk. Yet, starting in 2021, after fixed mortgage rates declined to historically low levels, often below 2%, the percentage of variable rate mortgages increased to the point where they became more than half the market.

The market became so complacent and accustomed to low rates, participants behaved as if rates would never rise again. Market professionals that gave this advice behaved recklessly, in our opinion. Mortgage brokers should describe how mortgages work and the risks involved. They should not be making interest rate predictions. Recent experience is the proof - they all got it wrong. - A gambling mentality infected the mortgage market. Persistent low interest rates forced investors into riskier asset classes, looking for higher returns. Low rates fuelled asset price appreciation. A recklessly exuberant mentality took hold: stocks, crypto, and real estate always go up in price, right? You can’t lose!

Now reality is setting in as rates return to more normal levels. In our view, this exuberant, gambling mentality is not suitable to the housing market. Government housing and financial policies should encourage household formation and home ownership, not speculation in single-family housing. Homeowners should be advised to assess the risks, not just the opportunities. They should be encouraged to finance their homes in a secure manner that provides peace of mind. We hope this gambling mentality departs from the housing market soon.

The Mortgage Stress Test Makes Things Worse

While pointing out the reasons why variable rate mortgages became so popular, we would be remiss if we did not point out how the mortgage stress test makes the situation worse. We are not fans of the stress test. We think it unfairly affects new homebuyers, unnecessarily crimps household formation and is an inequitable remedy for the risk it was meant to address. Plus, like many government policies it has unintended consequences. Today, we see this as the stress test forces the most vulnerable borrowers into risky variable rate mortgages as rates are rising.

Now that the qualifying rate of 5.25% no longer applies in the stress test (a sign of the test’s poor design, perhaps?) we are seeing circumstances where many mortgage customers can qualify for a stressed variable rate mortgage, but not a stressed fixed rate mortgage. The lower variable rate plus two percent is easier to qualify for than the higher fixed rate plus two percent. Many of these borrowers marginally qualify and do not have extra financial resources on hand. A variable rate mortgage in a rising rate environment can place these borrowers under financial stress. A stress test intended to reduce risk is now actually increasing risk – an unintended consequence of bad government policy that many average Canadians are now paying for.

Unhappy With Your Variable Rate Mortgage?

Many of you are now in a mortgage that is causing you pain. No one can control where rates are going. Nor can we predict where they will go in the future. Many of us took risks we should not have. You may have had faith in an advisor or mortgage broker that encouraged you to take on variable rate mortgage risks that you did not fully understand. Whatever the reason, you need to take control of your finances because it is you that bears the risk and the cost, not the mortgage broker.

We still see many advisors advocating for their customers to take a variable rate today on the assumption that rates will surely decline. Some are advising to take a short-term fixed rate mortgage, say a two or three-year mortgage, on the assumption that rates will surely be lower in two or three years. Perhaps these are good options for some, but these are dangerous assumptions to be making. We do not know where rates will be in two or three years. What we do know is that rates are now at levels that are normal when compared to the past and the risks in the mortgage market and the broader economy have yet to completely unfold. Interest rates could go in either direction or they could also stay ‘elevated’ for an extended period.

These uncertain financial conditions can be stressful. Our advice is to avoid making crystal ball predictions of the future and make the mortgage decision that you can afford and that provides you with peace of mind.

If you are stuck in a variable rate mortgage you may decide to:

- Stay with your variable rate mortgage. You may be assuming that the Bank of Canada is close to being done raising rates and that rates may decline in the near future. There is no market consensus on what will happen to rates in the next year, let alone further down the road. No one can predict future interest rates, so this is a decision that comes with some risk.

If you have an adjustable-rate mortgage your payments will continue to increase if rates rise further. Be sure you have the resources to afford the higher payments if they occur. It is not just about whether a variable rate averages out better than a fixed rate over time, it is also about whether you can survive the sudden and rapid spike in interest rates; - If you have a static payment variable rate mortgage you may have already reached your trigger rate and been contacted by your bank. They all handle these situations differently so talk to them and understand your options. If the interest amount is larger than your current payment you should increase your payment to continue amortizing your mortgage. If you cannot do that, you will end up in negative amortization where the principal balance of your mortgage increases. Some banks will allow your amortization and mortgage balance to increase to a point. This can provide short-term relief to your monthly cash flow but increases the cost of your mortgage materially over time. Talk to an advisor, understand your options, and make the best choice for your own personal financial situation.

- You may prefer to convert or refinance into a fixed-rate mortgage with your current lender. This could remove interest rate risk going forward and secure your financing for the future, but it does come at a cost. Fixed rates are higher than variable rates. Converting from a variable-rate mortgage to a higher rate fixed-rate mortgage with your current lender can work but lenders don’t often offer their best rates for a variable-rate to fixed-rate mortgage conversion.

- Refinancing with another lender may be the best way to get the best fixed rate. This can save you money, but you will need to be re-underwritten by the new lender and pass the stress test at current rates.

Last Word

We are living in uncertain times. Recent events demonstrate that it is important that you receive unbiased advice from a mortgage broker that prioritizes your best interests ahead of their profits. Your mortgage broker should not be affiliated with any lender or have special deals with favored lenders. They should be focused on you. They should provide a detailed explanation of the mortgage products you are considering, show you multiple lender alternatives and avoid reckless predictions about the future.

The mortgage decision is yours to make. Understand the risks. Be careful. Accept that the market can be difficult and may cost more today. It may not be long before everyone becomes accustomed to a higher interest rate environment and the market adjusts. In the meantime, protect your own interests and don’t let a banker, mortgage broker or advisor twist your arm into a mortgage deal that is not right for you.

Frank Mortgage is a new online mortgage brokerage built to allow borrowers to control their own financing, not rely so heavily on third parties and avoid the mistakes of the past. If you want unbiased advice and you want to talk to a neutral mortgage broker that will tell you about mortgage products and what they mean to you without making any reckless interest rate predictions, please call us at 1-888-850-1337 or go to www.frankmortgage.com where you can connect with us and book a free consultation with one of our mortgage advisors.

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts