Monthly Market Update - January 15, 2024

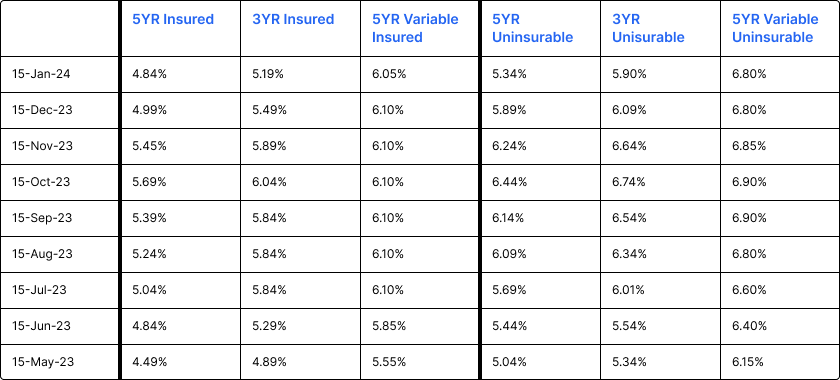

Optimism is returning to the housing and mortgage markets. With the rate hiking cycle apparently over, we are seeing a pick-up in activity. Fixed mortgage rates have declined with five-year fixed rates below 5% once again available. Variable rates remain high and will stay there until the anticipated rate reductions by the Bank of Canada.

The Bank of Canada held rates unchanged at their scheduled announcement on December 6, and they cautioned the market about being too optimistic about rate cuts. The Bank remained cautious, expressing concern about inflationary pressures and leaving the door open to further increases. Their next rate announcement is scheduled for January 24.

Bond yields declined further into the end of December, but have increased slightly in early January. Nevertheless, all lenders have lowered their fixed mortgage rates in January.

Housing sales in December saw an unexpected spike. That might just be participants motivated to close out the year end but hopefully it is a positive sign for the future. Housing affordability remains a challenge but lower fixed rates will help.

Mortgage Market

- The prime rate remains at 7.20%

- Fixed mortgage rates declined this past month, with five-year insured mortgage rates available below 5% at several lenders

- Five year government bond yields finished the year at 3.17%, which is 0.25% higher than the end of 2022. They peaked at 4.42% in October 2023

- The five year government bond yield is 3.28% today (Jan 15, 2024)

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Fixed mortgage rates continue to decline in response to the decline in bond yields

- Fixed mortgage rates are more than 1% lower than variable mortgage rates.

- Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- Over 2.2 million mortgages are expected to renew over the next two years - CMHC

- “It’s still too early to consider cutting our policy rate.” - Bank of Canada

- There may be rate cuts in 2024 but first we need to see several months of deceleration in underlying inflation first - Bank of Canada

- Markets have been a bit aggressive in their pricing of early and often rate cuts - BMO

- RBC takeover of HSBC Canada receives government approval

- The expected decline in interest rates over the course of 2024 should help soften the impact of mortgage renewal payment shocks - RBC

- Inflation in Canada was higher than expected at 3.1% in October, unchanged from the prior month. December inflation data will be released on January 16

Housing Market

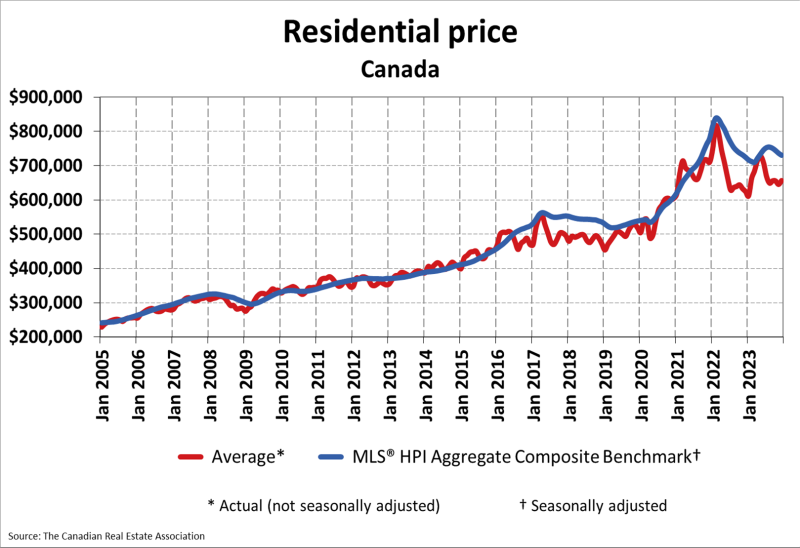

The MLS Home Price Index (HPI) was down 0.8% month-over-month in December 2023. The actual (not seasonally adjusted) national average sale price was up 5.1% year-over-year. The actual national average home price is $657,145 at the end of December 2023.

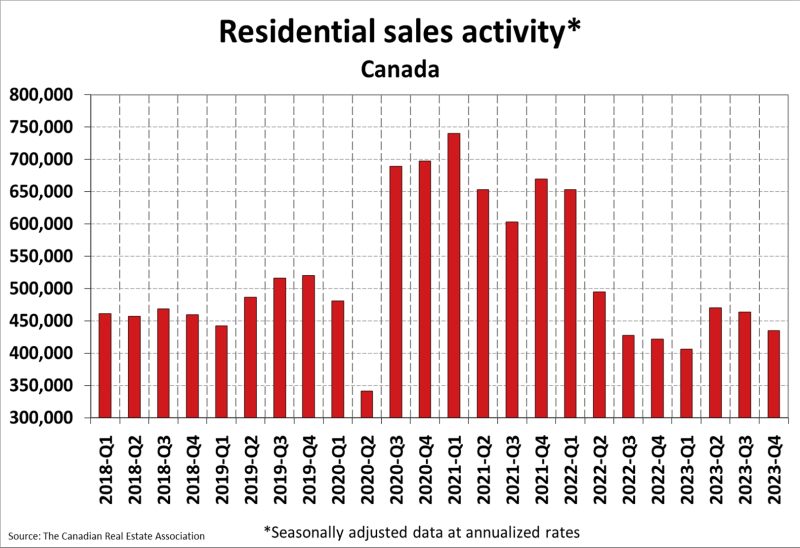

Housing Sales were up a surprising 8.7% month-over-month in December 2023. Actual (not seasonally adjusted) sales were up by 3.7% over the prior year, December 2022.

Housing Market Headlines

- New listing activity in December declined 5.1% month-over-month - CREA

- Nationally, there were 3.8 months of housing inventory for sale at the end of December 2023. The long-term average is closer to five months - CREA

- Home sales totaled 443,511 units in 2023, a decline of 11.1% from 2022 - CREA

- Price declines have been predominantly located in Ontario markets, particularly the Golden Horseshoe, and to a lesser extent British Columbia -CREA

- Prices continue to climb in Alberta, New Brunswick and Newfoundland & Labrador - CREA

- Calgary recorded the highest year over year price appreciation (10.7%) - Royal LePage

- Estimated 4.5% decline in recreational property prices in 2023 - Royal LePage

- 2023 was slowest year for housing sales in over two decades

- Rebound in housing sales activity projected for 2024 - CREA

- Even a hint of a firmer demand/supply balance amid pending rate cuts could readily fire the housing sector back up again - BMO

- There has been a big shift in Canadians sentiment around the housing market. A majority of Canadians believe that now is a good time to purchase a home - RBC

- “We believe that the ‘great adjustment’ to tolerable, mid-single-digit borrowing costs will have a firm grip on our collective consciousness after only modest rate cuts by the Bank of Canada.” - Royal LePage

- More seniors are potentially staying homeowners well into their later years - CMHC

- Close to 2 out of 3 Canadians believe that the federal government is doing a “very poor” or “poor job” at managing housing policy to improve affordability - Nanos Research for Bloomberg News

What are Pundits Predicting for 2024?

- 2024 predicted as a year of economic pain and transition - Bank of Canada

- National home sales are forecast to rebound to over 490,000 units - CREA

- House prices forecast to increase in 2024 by:

- 5% - Royal LePage

- 0.5% - RE/MAX

- 2.3% - CREA

- 1.9% - RBC

- The Bank of Canada is expected to start cutting rates by mid-year. The current target overnight rate of 5.0% is forecast to be lower by the end of 2024:

- 4.0% - RBC, Scotia & BMO

- 3.50% - CIBC, TD

- The big five banks also predict that the five-year government bond rate will end the year somewhere between 2.90% and 3.50%. No big change is expected in fixed rates.

- Even if rates decline slightly in 2024, debt-servicing costs will likely continue to climb in the coming years - Bank of Canada

Frank Mortgage's View on 2024

- We believe that the Bank of Canada will cut rates in 2024 but not by an amount significant enough to meaningfully lower overall borrowing costs

- Housing affordability will continue to be the main topic of discussion

- We are optimistic for a more active housing market in 2024 and are already seeing a pick-up in activity

- Most of the rate decline that matters has already occurred as five-year fixed mortgage rates have declined by 0.85% since October

- Fixed mortgage rates are materially lower than variable rates and second-half 2024 rate cuts by the Bank of Canada may close that gap

- We expect most customers to continue to favor fixed rates since variable rates are higher, rate uncertainty persists and homeowners remain justifiably risk adverse

- We expect the capital markets in 2024 to be volatile. This will affect rates and housing. The path to better mortgage and housing markets might be a little bumpy

- We also caution all customers to take the predictions noted above with a grain of salt. The people that make market predictions like those noted above got it wrong in 2023, 2022 and 2021. What are the odds they get it right this year?

Do you have questions about a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts