Monthly Market Update - April 15, 2024

After declining in early March, some fixed mortgage rates have increased in April. Variable-mortgage rates remain flat. Housing sales slowed in March but are expected to pick up into the spring.

The Bank of Canada held rates unchanged at their scheduled announcement on April 10. They have not changed rates since July 2023. They want to see that recent declines in inflation can be sustained before making any cuts to rates. Market expectations are for rate cuts to begin in either June or July.

The past month has seen a flurry of announcements from OSFI and the Federal Government about changes to mortgage underwriting rules and new plans to address the housing crisis. See the headlines below for a summary.

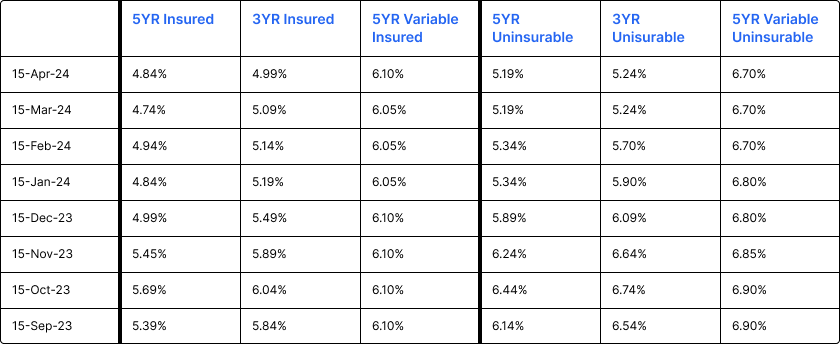

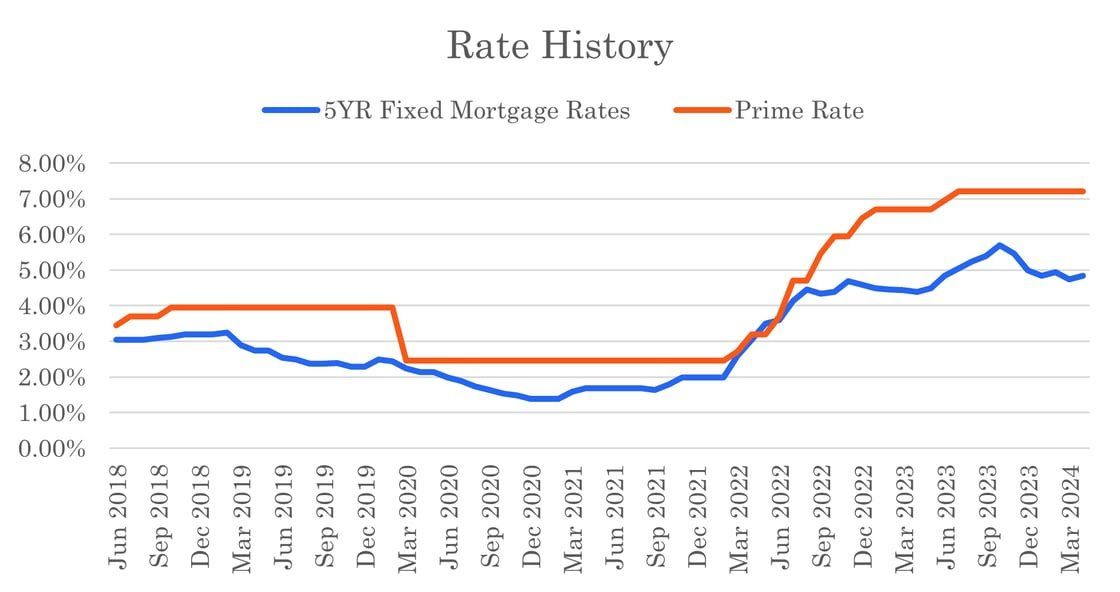

Five-year bond yields have fluctuated and are higher than they were at this time last month. Five-year fixed mortgage rates have increased slightly at many lenders. The lowest insured, fixed mortgage rates remain below 5%.

Variable rates remain high and will stay there until we see the anticipated rate reductions by the Bank of Canada.

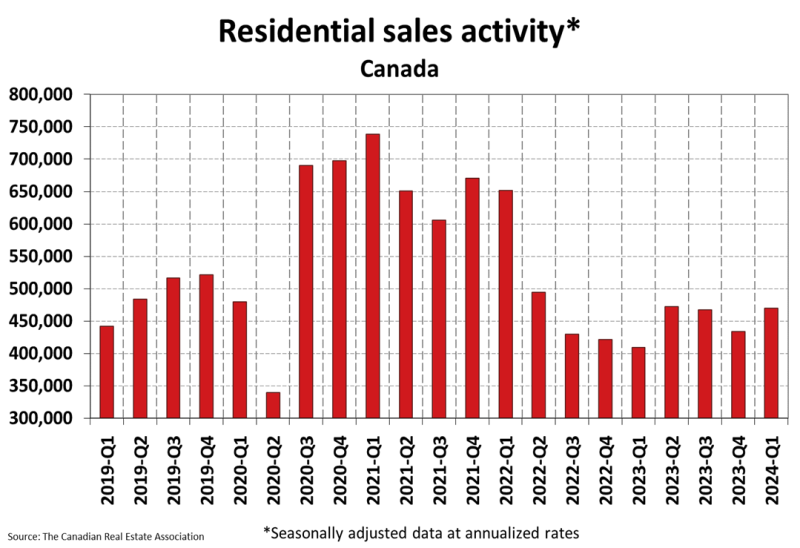

Housing sales were mostly unchanged month-over-month in March. Sales activity remains below the 10 year average.

Mortgage Market

- The prime rate remains at 7.20%

- A recent rise in bond yields is putting upward pressure on fixed mortgage rates. Five-year insured mortgage rates below 5% remain available with multiple lenders

- The five year government bond yield is 3.78% today, which is 0.13% higher than last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Five-year fixed mortgage rates rose slightly in the past month

- Fixed mortgage rates are more than 1% lower than variable mortgage rates

- Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- “We’ve come a long way in the fight against inflation, and recent progress is encouraging. We want to see this progress sustained.” - Bank of Canada

- Inflation is now expected to hover close to 3% until the end of the first half of 2024, dipping below 2.5% in the second half and reaching the Bank’s 2% target at some point next year. - Bank of Canada

- The Bank of Canada is on track to cut rates this summer and into the fall - RBC

- Rate cuts will be ‘slower and shallower’ - former Bank of Canada Governor Mark Carney

- RBC closes purchase of HSBC Canada. This removes a mortgage competitor from the market.

- Multiple rate cuts unlikely in 2024 - CIBC

- Canadian banks are starting to get the problem of ultra-long amortization periods on mortgages under control. - OSFI

- Canada's Competition Bureau called on the federal government to waive the requirement that uninsured mortgage borrowers pass the mortgage stress test when renewing their loans. OSFI has declined to reconsider this rule.

- Inflation in Canada slowed to 2.8% in February. The data for March will be released on April 16, 2024.

Housing Market

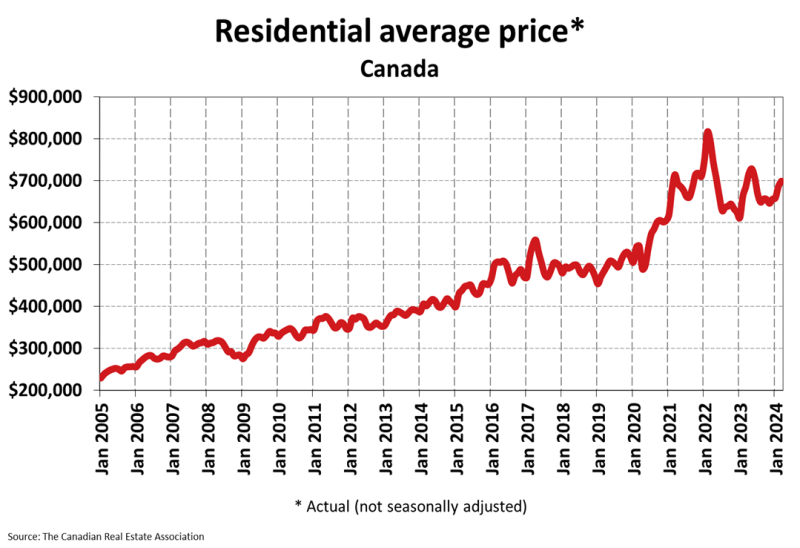

The MLS Home Price Index (HPI) was down 0.3% month-over-month in March 2024. The actual (not seasonally adjusted) national average sale price was up 2% year-over-year. The actual national average home price was $698,530 at the end of March 2024.

Housing Sales rose by 0.5% month-over-month in March 2024. Actual (not seasonally adjusted) sales were up by 1.7% over the prior year, March 2023.

Housing Market Headlines

- New listing activity in March declined 1.6% month-over-month - CREA

- Nationally, there were 3.8 months of housing inventory for sale at the end of March 2024. The long-term average is closer to five months - CREA

- “While the official March monthly numbers were quite flat, anecdotal evidence from late last month and early April suggests activity is ramping up.” - CREA

- Home prices to increase by 9% in 2024 - Royal LePage

- Home prices expected to increase 4.9% in 2024 - CREA

- BC's proposed 20% house flipping tax would have minimal impact on home prices, but decrease sales by 1.7 percent. - BCREA

- Recreational real estate market revival on the horizon - Royal LePage

- First-time homebuyers in Canada under 30 years of age are successfully buying their first home sooner than they expected by adapting to larger trade-offs that would have traditionally been considered 'deal-breakers' - Houseful survey

- Anticipated interest rate cuts in the coming months, coupled with Canadians' optimism regarding their financial situations, suggests that activity in the real estate market is poised to grow quickly once rates start to decline. - Dye & Durham

- Owners of multiple properties remain the drivers of real estate purchasing in Ontario. The story over the past decade-plus has been a surge in the number of homes purchased by multiple-property owners - Teranet

- Affordability in the home ownership market will be a concern for the next three years, as declining mortgage rates and the country’s strongest population growth since the 1950s will likely spur a rebound in home sales and prices. - CMHC

- Closing the housing gap would require the construction of 436,000 units per year on average and 1.3 million new units overall by 2030 - Parliamentary Budget Office

- Failure to lower housing costs could put our entire economy at risk - RBC

- Home ownership feels out of reach for 76% of Canadians who don't own property - CIBC

- Canada doesn’t have enough skilled tradespeople to build its way out of its current housing shortage - CBRE Group

- Lower rates do not improve housing affordability - US Federal Reserve

Summary of New Government Housing Proposals

- Providing builders access to unused government-owned land to build affordable housing

- $15 billion in additional loans for the Apartment Construction Loan Program

- Addressing the skills gap by supporting workers in skilled trades, including apprenticeship opportunities

- Additional funds for the Housing Accelerator Fund

- Launching a new Affordable Housing Fund

- A new infrastructure fund to accelerate construction or upgrades of infrastructure to allow more homes to be built

- Launching a new rental protection fund

- Provide homeowners loans of up to $40,000 to add a secondary suite to their homes

- Extending the GST exemption for new build rentals to student housing built by universities and colleges

- Consulting on proposals to restrict the purchase of existing single-family homes by large corporate investors

- Apparently more details on these plans will be available in the budget to be revealed on April 16, 2024

- A comprehensive plan to address the housing crisis is long overdue. Some of these measures could be positive but time will tell if they are actually implemented as proposed. Hopefully this is a real attempt at practical policy and not just the optics we so often see from Ottawa.

Do you have questions about a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts