Monthly Market Update - August 15, 2024

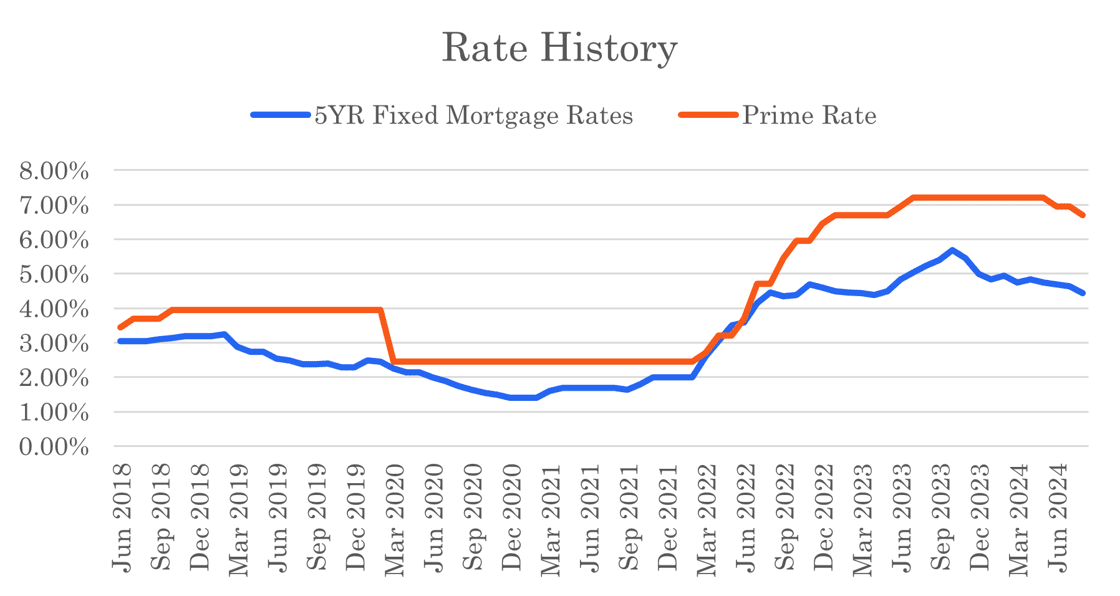

Another interest rate cut from the Bank of Canada on July 24 indicates a cooling economy. Weaker economic conditions are not good news, but the interest rate relief brought by lower rates is welcome.

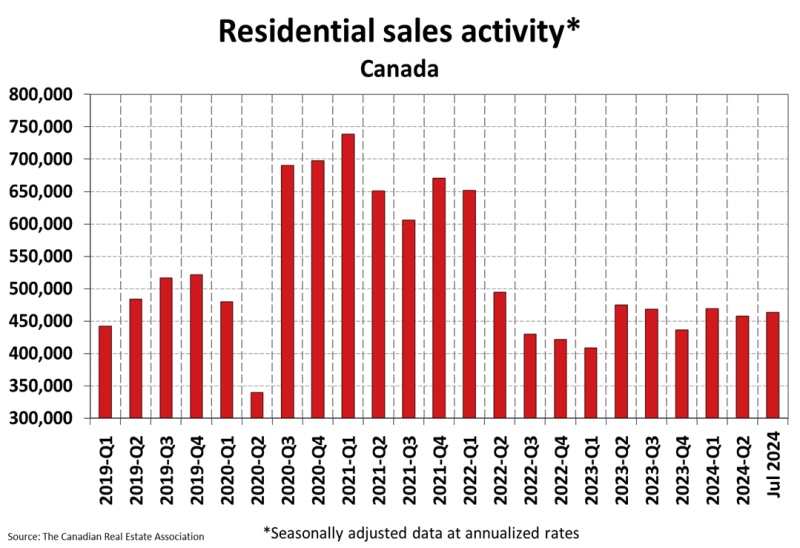

The Canadian mortgage and housing markets continue their quiet summer, but activity is expected to pick up in the coming months. Housing sales and prices have been relatively flat through the summer. The rate cuts will take some time to have an effect but expectations of further cuts should spur new activity and release some of the pent-up demand, starting this fall. This could mean that brighter times are ahead for the mortgage market.

Homes for sale inventory continues to build in most major markets. A buyers market is emerging, presenting market entrants with more choice than in prior periods.

The next Bank of Canada rate announcement is scheduled for September 4, 2024. Expectations for a rate cut in September are mixed.

There are some material differences between the offered mortgage rates at lenders across the country. This is true for both new purchases and mortgage renewals. New and existing mortgage borrowers should check with us to find out where they can find the best rates. At Frank Mortgage, we have been able to negotiate rates lower than the advertised rates at several lenders. The market is competitive and lenders will often provide discounts in a competitive situation. We can help you with that kind of negotiation.

Five-year bond yields have declined materially in the past month and fixed mortgage rates have followed. Our best insured, five-year, fixed mortgage rate is now 4.44%.

Despite some rate relief so far this summer, variable rates remain high. They will only decline further in response to additional rate reductions by the Bank of Canada.

Mortgage Market

- The prime rate declined to 6.70%

- Bond yields declined to two year lows. Five-year insured mortgage rates have dropped to around 4.5% at a few lenders

- The five year government bond yield is 2.98% today, down from 3.35% last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Fixed mortgage rates have declined in the past month

- Fixed mortgage rates are more than 1% lower than variable mortgage rates

- Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- There will be another rate cut in September - CIBC

- It's reasonable to expect more rate cuts - Bank of Canada

- The Bank of Canada will cut rates by another 1.75% by the end of 2025 - TD

- As of Aug 1, first-time homebuyers purchasing newly built homes are able to get insured mortgages with amortization periods as long as 30-years. They were previously limited to 25 years. - CMHC

- 31% of first-time homebuyers receive financial assistance for their down payment from family - CIBC

- Uninsured mortgage loan volumes growing faster than insured ones as house prices increase - Statistics Canada

- Lenders cut rates following supersized drop in funding costs - Financial Post

- Mortgagors renewing into higher rates in the next year will be stressed but the worst is behind them and with some rate relief coming, they will have options - BMO

- Inflation in Canada declined to 2.7% in June. Inflation data for July will be released on August 20, 2024.

Housing Market

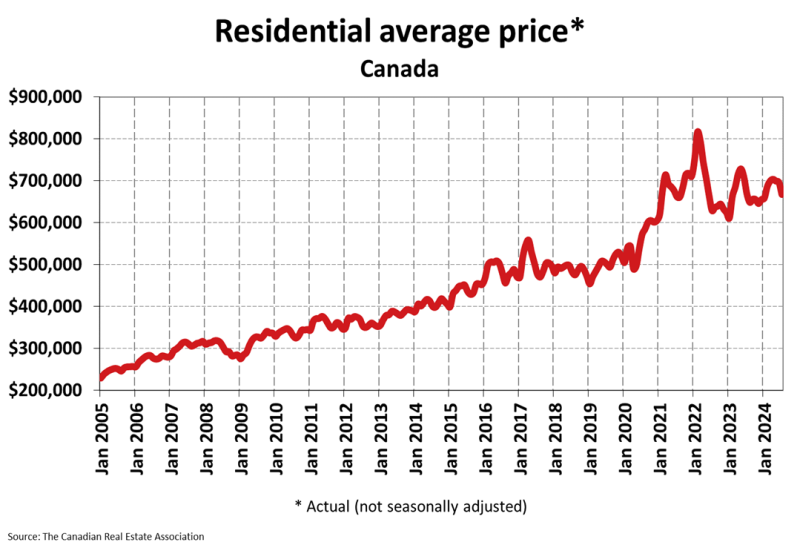

The MLS Home Price Index (HPI) increased by 0.2% month-over-month in July 2024. The actual (not seasonally adjusted) national average sale price was down 0.2% year-over-year. The actual national average home price was $667,317 at the end of July 2024.

Housing Sales declined by 0.7% month-over-month in July 2024. Actual (not seasonally adjusted) sales were up by 4.8% over the prior year, July 2023.

Housing Market Headlines

- New listing activity in July rose 0.9% month-over-month and is up overall by 22.7% from the prior year - CREA

- Nationally, there were 4.2 months of housing inventory for sale at the end of July 2024. The long-term average is closer to 5 months - CREA

- While there were early signs of renewed momentum in June following the Bank of Canada’s first interest rate cut since 2020, activity in Canada’s housing market took a pause in July - CREA

- Thee move-up/down segments, as well as investors, have been fueling detached home-buying activity in the first six months of 2024 in the Greater Toronto Area (GTA), Greater Vancouver Area (GVA) and Fraser Valley - RE/MAX

- Many markets have a healthier amount of choice for buyers than has been the case in recent years - CREA

- Elevated borrowing costs are tempering housing demand, reducing the risk of the housing market overheating - Bank of Canada

- Government housing strategy looks to increase supply, not lower house prices - Bloomberg

- Canada's housing market recovery to be gradual - RBC

- The second interest rate cut in a row is not likely to ignite the national housing market, but it could have a modest positive impact - BMO

- Monthly changes in sales activity were generally small amongst the larger centres in July. Interestingly, declines in Calgary and the Greater Toronto Area were mostly offset by gains in Edmonton and Hamilton-Burlington - CREA

- Toronto condo sales lowest in 27 years - Urbanation

- Rate drops have not always led to a boost in the real estate market - Wowa

- The impact of rapid population growth on housing affordability in Canada is a concern - Bank of Canada

- Canada must build 4.2 million new homes in the next decade to restore balance in the housing markets. This requires constructing 420,000 homes annually which is about 70 per cent more than the average construction output in recent years - Oxford Economics

- For Canadians looking to balance amenities, employment opportunities, and homes they can afford, medium-sized cities like Edmonton, Halifax-Dartmouth, and Kitchener-Waterloo dominated Canada's top ten best places to live - Zolo

- Housing affordability in Canada the worst in a generation - International Monetary Fund

- Housing starts down 9% in June - CMHC

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts