Monthly Market Update - June 17, 2024

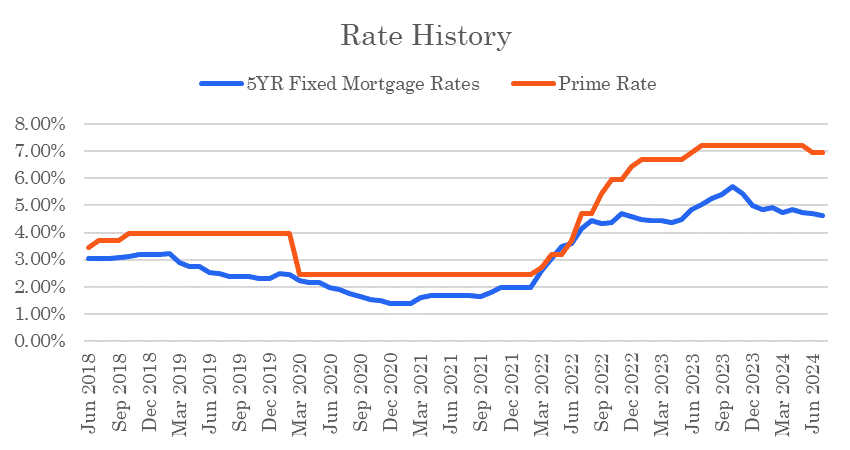

Finally, a small bit of interest rate relief has arrived. On June 5, the Bank of Canada cut their target interest rate by 0.25%. While this one cut itself is not significant, it signals a significant change in monetary policy going forward. More rate cuts are expected in the second half of the year.

Variable mortgage rates have declined by 0.25% in response to the Bank's rate cut. Fixed mortgage rates have also declined slightly. This is all good news for mortgage borrowers and more good news may be coming if the market expectations are correct that more cuts are on their way.

The main theme in the housing market depends on the location. In Toronto and Vancouver it is the significant increase in inventory for sale. In Calgary it is the continuing increase in prices and market activity. Nationally, the market has been quieter than usual for a spring market.

The next Bank of Canada's next rate announcement is scheduled for July 24. The financial markets currently place about a 40% chance on a rate cut in July.

At Frank Mortgage, we are seeing some sidelined buyers returning to the market. They are obtaining rate holds and are out shopping for homes. Sales activity still lags somewhat, however, as buyers and sellers are not agreeing on pricing. Homes for-sale inventory is up in major markets like Toronto, particularly in the condo market where sales have been declining.

Homes sales were slightly lower across Canada in May. New listings edged higher. Housing prices are mostly unchanged nationally. Sales activity remains below the 10 year average.

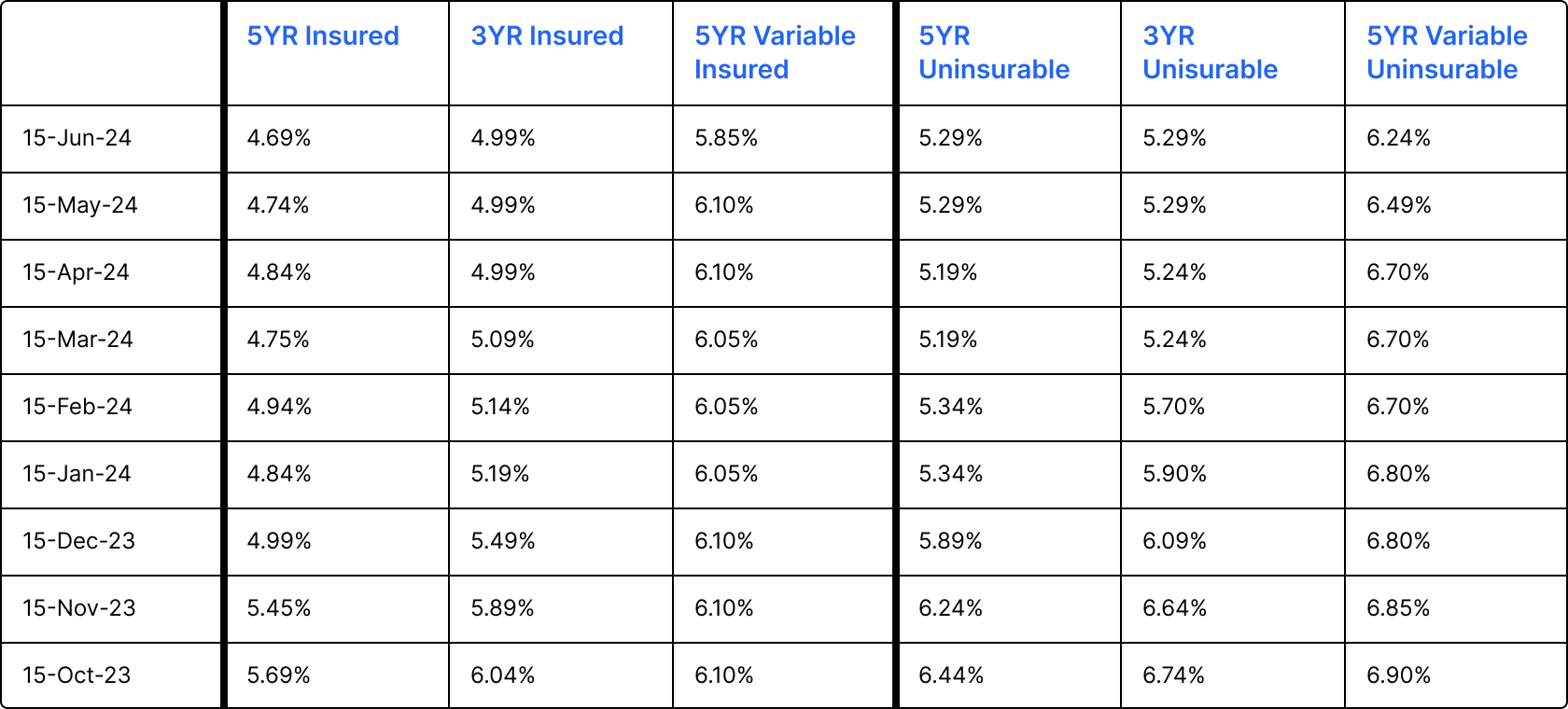

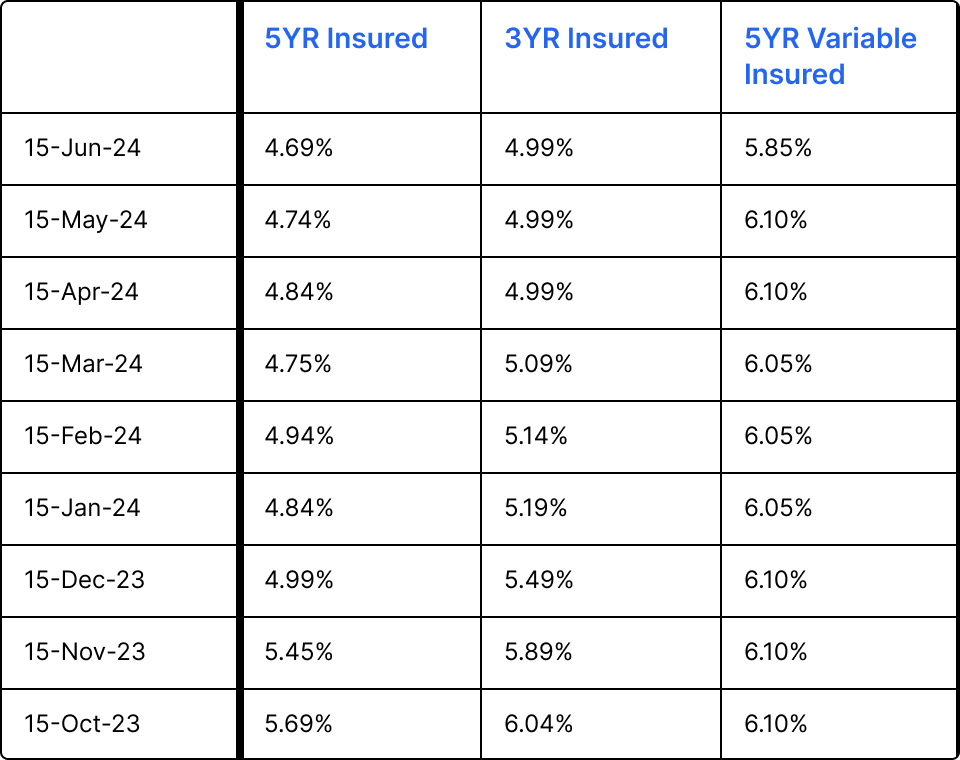

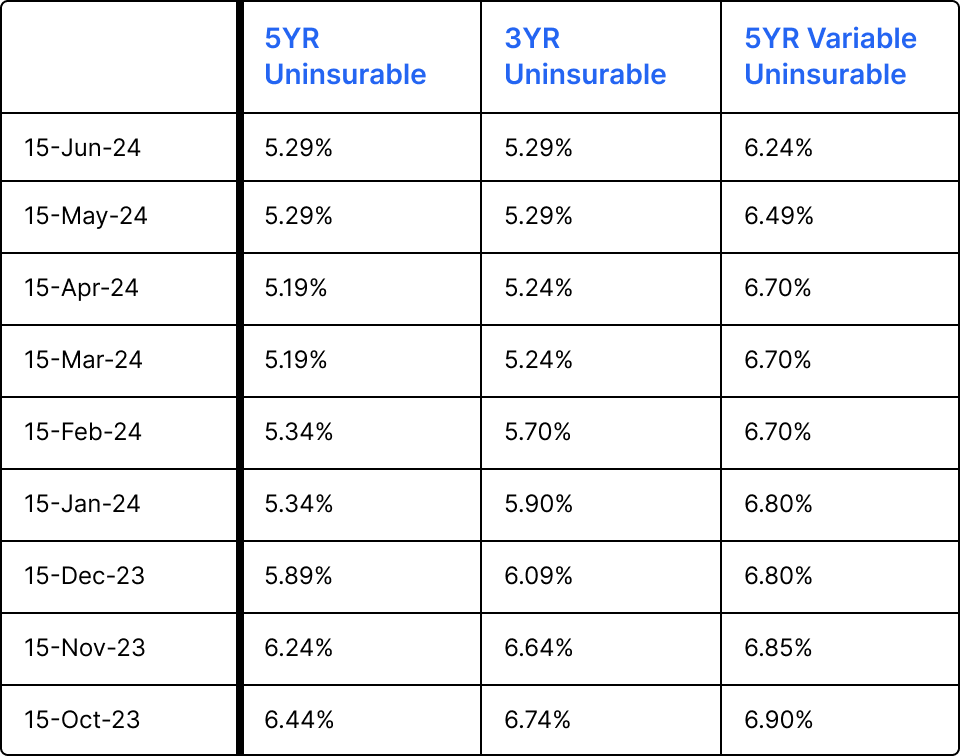

Five-year bond yields have declined by about 0.30% compared to last month. Five-year fixed mortgage rates have not changed dramatically month-over-month but the trend is slightly lower. The lowest insured, fixed mortgage rate is now 4.69%.

Variable rates remain high and will only decline further in response to additional rate reductions by the Bank of Canada.

Mortgage Market

- The prime rate declined to 6.95%

- Bond yields have also declined, responding to the weaker economic data in Canada. The market now awaits news on a possible second rate cut in July. Five-year insured mortgage rates below 5% remain available with multiple lenders

- The five year government bond yield is 3.35% today, unchanged from last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Five-year fixed mortgage rates did not change materially in the past month

- Fixed mortgage rates are more than 1% lower than variable mortgage rates

- Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- Borrowers must adapt to the "new normal" of higher rates - BoC

- The first rate cut in more than four years will not be enough to help most prospective homebuyers feeling sidelined by high borrowing costs - Global News

- Even when the Bank of Canada begins to cut rates, it will take months before it begins helping consumers - Financial Post

- It is reasonable to expect three, maybe four rate cuts by December - CIBC

- Most of its clients remain resilient despite higher interest rates and rising payments, but the bank acknowledges ‘pockets of stress’ among select borrowers as delinquencies continue to rise - RBC

- 76% of mortgage borrowers say they are anxious about the renewal process - Mortgage Professionals Canada survey

- OSFI warns of mortgage risks to Canadian lenders. Of particular concern are variable-rate mortgages with fixed payments – particularly those which are already in negative amortization

- CMHC released it latest Mortgage Industry Report. Key findings include:

- Residential mortgage debt growing at its slowest rate in 23 years as borrowers continue to face high rate and affordability challenges

- Total residential mortgage debt across the country was up by 3.4% in February compared with the same time last year, bringing the total to $2.16 trillion

- Borrowers are showing a preference for shorter-term fixed-rate mortgages, looking to fix their borrowing costs while also hoping to take advantage of lower rates in the not-too-distant future

- Canadians are dipping into their savings to pay their mortgages, especially low- to mid-income households

- Mortgage delinquency rates remain low

- More than six out of ten Canadians with a mortgage are financially stressed about it - Leger survey

- Among Canadians looking to renew their mortgage in the next two years, 66% plan to renew with a fixed rate, 11% with a variable rate, and 24% are undecided - Leger survey

- Inflation in Canada slowed to 2.7% in April. The data for May will be released on June 25, 2024.

Housing Market

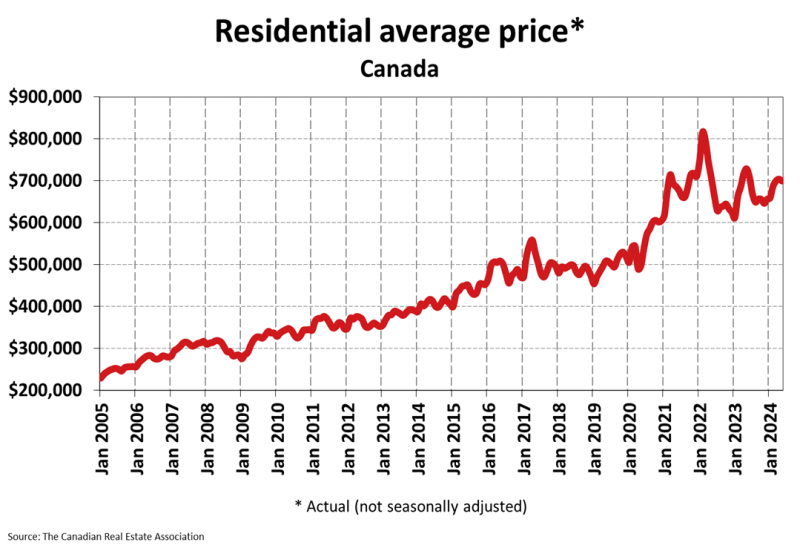

The MLS Home Price Index (HPI) declined by 0.2% month-over-month in May 2024. The actual (not seasonally adjusted) national average sale price was down 4% year-over-year. The actual national average home price was $699,117 at the end of May 2024.

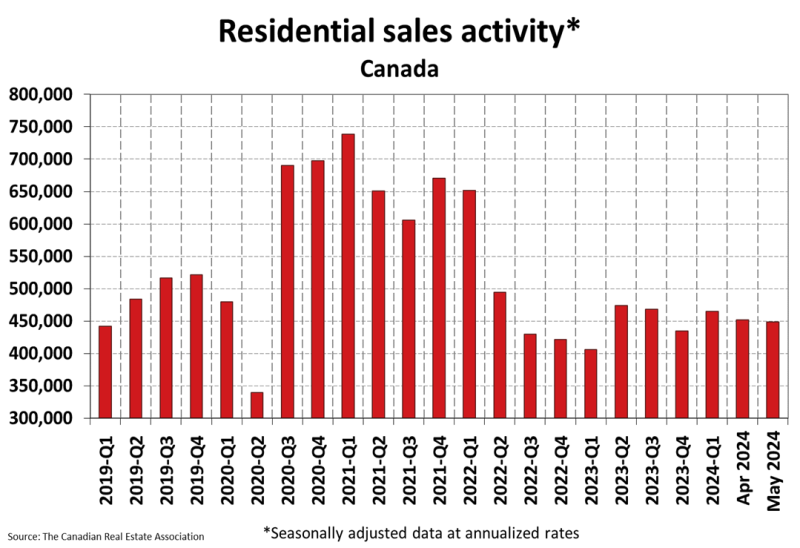

Housing Sales declined by 0.6% month-over-month in May 2024. Actual (not seasonally adjusted) sales were down by 5.9% over the prior year, May 2023.

Housing Market Headlines

- New listing activity in May increased by 0.5% month-over-month - CREA

- Nationally, there were 4.4 months of housing inventory for sale at the end of May 2024. This is the highest level since the fall of 2019 but below the long-term average of closer to five months - CREA

- “May was another sleepy month for housing activity in Canada, although it may prove to be the last of those now that interest rates have moved lower.” - CREA

- Regionally, prices are generally sliding sideways across most of the country. The exceptions remain Calgary, Edmonton and Saskatoon, where prices have steadily ticked higher - CREA

- Spring housing market stalls as homebuyers remain on the sidelines - Canadian Mortgage Trends

- Half of Canadians in our larger cities (Toronto, Montreal and Vancouver) would consider moving and buying a property in one of Canada's more affordable cities - Royal LePage

- "We now know for a fact that the Bank is starting to reduce rates and probably there’s more coming that way. And I think that is going to improve the psychology and brighten the mood in the real estate market" - BMO

- Canadians' desire to own a home remains steadfast, with 74% per cent of prospective homeowners surveyed still feeling hopeful that they will be able to purchase a home in the next five years - TD

- Housing starts in Canada increased 10% month-over-month in May - CMHC

Do you have questions about a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts