Monthly Market Update - October 13, 2023

Housing and mortgage markets adjusting to "Higher For Longer".

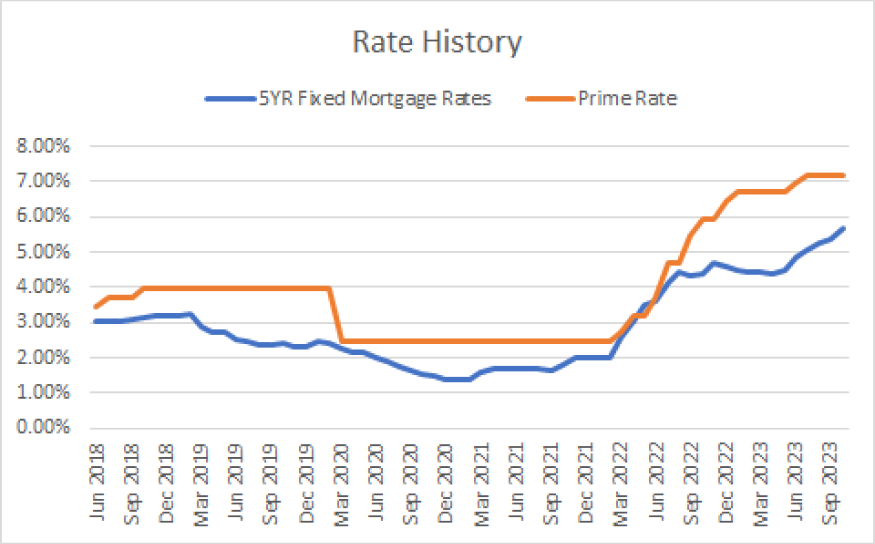

The Bank of Canada held rates unchanged at their scheduled announcement on September 6, but they left the door open to further increases. Their next rate announcement is scheduled for October 25. Bond yields rose again in September, pushing fixed mortgage rates higher. Hopes for lower interest rates in the near term are all but extinguished.

Housing sales declined in most markets. House prices have likewise declined in many markets. Inventory for sale has been increasing, indicating a return to a more balanced market.

Mortgage Market

- The prime rate remains at 7.20%

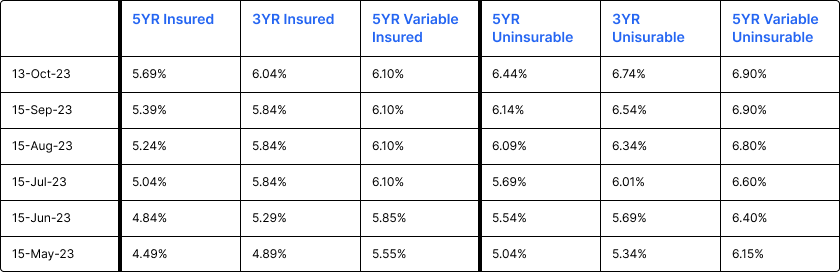

- Fixed mortgage rates rose again this past month, as shown below:

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Fixed mortgage rates continued to rise in response to bond yields increasing in the September.

- Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- The Bank of Canada is not likely to start cutting rates until mid-2024. We expect little relief in the interim - RBC

- No rate cuts until third quarter of 2024 - BMO

- Higher for longer interest rate environment is squeezing more borrowers - International Monetary Fund

- Each month that passes, roughly 2% of mortgage holders face renewal at sharply higher interest rates - Desjardins

- Surging bond yields add to Canadian homeowner's mortgage pain as renewals loom - CTV

- Borrowers with variable rates but fixed monthly payments are “at risk of suffering a significant payment shock” - OSFI

- Bank of Canada won't rule out higher rates amid rising geopolitical risks - Financial Post

- Inflation in Canada came in higher than expected at 4% in August, up from 3.3% in July. September inflation data will be released on October 17.

Housing Market

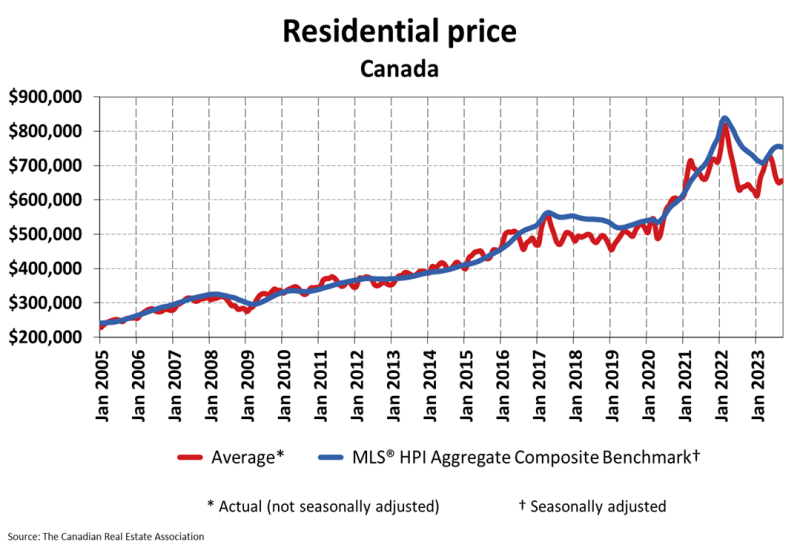

The MLS Home Price Index (HPI) was down 0.3% month-over-month in September 2023, the first decline since March 2023. The actual (not seasonally adjusted) national average sale price was up 2.5% year-over-year.

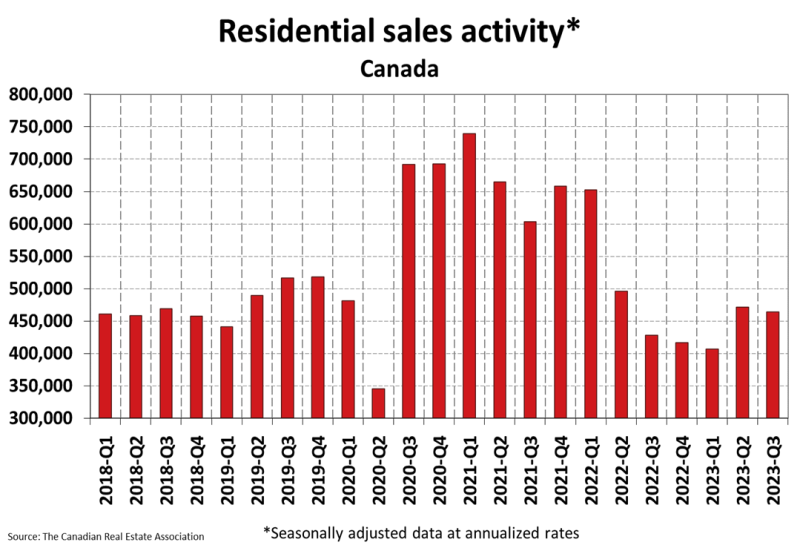

Housing Sales were down 1.9% month-over-month in September 2023. Actual (not seasonally adjusted) sales were up by 1.9% over the prior year, September 2022.

Housing Market Headlines

- New listing activity in September rose 6.3% month-over-month - CREA

- "Nationally, there were 3.7 months of inventory at the end of September 2023 - up from 3.5 months in August, but still below the long term average of about five months." - CREA

- Royal LePage downgrades Q4 home price forecast.

- Regionally, the steepest near-term sales and price drops should occur in B.C. and Ontario - TD

- Half of non-homeowners losing hope of buying a home in Canada - MPC Survey

- Buyers are willing to trade financial strain for the security of a place to call their own - Zolo

- At least $1 trillion investment required to achieve housing affordability - CMHC

- Single detached housing starts 25% lower that last year - CMHC

- Almost half of Millennial and Gen-Z Canadian new homebuyers say they will need financial assistance to buy a home - Zoocasa

- Only lower rates can revive Canada's housing market - Financial Post

Do you have questions about getting a new mortgage or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts