Monthly Market Update - Semptember 16, 2024

Great news for mortgage borrowers!! On September 4, the Bank of Canada announced another 0.25% interest rate cut. This is good and welcome news, but it is not the only good news this month. Today, Ottawa made a significant announcement about more flexible rules for mortgage borrowers, as follows:

- the cap on insured mortgages is being increased to $1.5 million from the current $1 million, and

- mortgage amortizations can be extended to 30 years for all first-time homebuyers (was previously only for buyers of new builds).

These mortgage changes are scheduled to take affect on December 15, 2024.

The interest rate cut from the Bank of Canada on September 4 was accompanied by pronouncements from the Bank of Canada that more cuts are coming. This rate easing cycle will clearly not be limited to just a couple of rate cuts. There is a clear intention to bring rates down materially. No one expects rates to return to covid-era levels but more rate relief will be warmly welcomed by mortgage borrowers.

The announced changes to the mortgage rules will make mortgages more affordable for first-time homebuyers. A 30-year amortization reduces a mortgage payment by close to 8% for most mortgages, compared to a 25-year amortization. This is a material improvement to affordability for many borrowers.

The increase to the cap on property value for insured mortgages from $1 million up to $1.5 million makes several markets accessible for new home buyers, especially in Southern Ontario and BC. Instead of needing a down payment of 20% for an uninsured mortgage on a home worth $1.5 million (equal to $300,000), you now will need a down payment for an insured mortgage of 5% on the first $500,000 and 10% on the rest (equal to $125,000).

The Canadian mortgage and housing markets enter the fall with expectations of an increase in activity. A quiet summer market is behind us. Rates cuts tend to take some time to have a measurable effect but we are seeing an increase in interest and activity within our customer base. If these rate cuts release some of the pent-up housing demand this fall, the market should stabilize.

Homes for sale inventory continues to build in many major markets. A buyers market is emerging, presenting market entrants with more choice than in prior periods.

The next Bank of Canada rate announcement is scheduled for October 23, 2024. The US Federal Reserve is also expected to cut rates this week, on September 18. This would add to the favorable conditions for future cuts by the Bank of Canada.

Five-year bond yields have declined materially in the past month and fixed mortgage rates have followed. Our best insured, five-year, fixed mortgage rate is now 4.19%.

Despite some rate relief so far this summer, variable rates remain high, with our best insured, five-year, variable mortgage rate now at 5.30%. Variable rates will only decline further in response to additional rate cuts by the Bank of Canada.

Mortgage Market

- The prime rate declined to 6.45%

- Bond yields continued to declined. Five-year insured mortgage rates have dropped to levels not seen since 2022.

- The five year government bond yield is 2.66% today, down from 2.98% last month. It peaked at 4.42% in October 2023

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Fixed and variable mortgage rates have declined in the past month

- Fixed mortgage rates are more than 1% lower than variable mortgage rates

- Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- Bank of Canada to Start Jumbo Rate Cuts by December - CIBC

- Bank of Canada governor raises prospect of big cuts as growth fears mount - Financial Times

- Lenders facing intensely competitive mortgage market, reconsider strategy - RBC

- We’ve been more careful in saying we won’t chase hot money, where our customer’s just shopping their mortgage at a below hurdle rate. But, where we sense there’s a multi-product, longer term relationship with a customer, we’ll certainly go after that hard - RBC

- The bank won’t be fighting as hard for a single customer shopping for the best mortgage rate. Will we be willing to think about a competitive price when we have multi-product? Absolutely. Will we think about a competitive price when it’s a mono-line relationship; probably not - Scotiabank

- Variable mortgage rates regaining traction as Bank of Canada cuts rates - Canadian Mortgage Trends

- Google searches for mortgage-related terms have skyrocketed, reaching their highest point since the pandemic's onset in March 2020 - Financial Post

- Most Canadians have managed to keep up with their mortgage payments despite the rise in interest rates. However, non-mortgage debt has surged - Statistics Canada

- Inflation in Canada declined to 2.5% in July. Inflation data for August will be released on September 17, 2024.

Housing Market

The MLS Home Price Index (HPI) was unchanged month-over-month in August 2024. The actual (not seasonally adjusted) national average sale price was up slightly by 0.1% year-over-year. The actual national average home price was $649,100 at the end of August 2024.

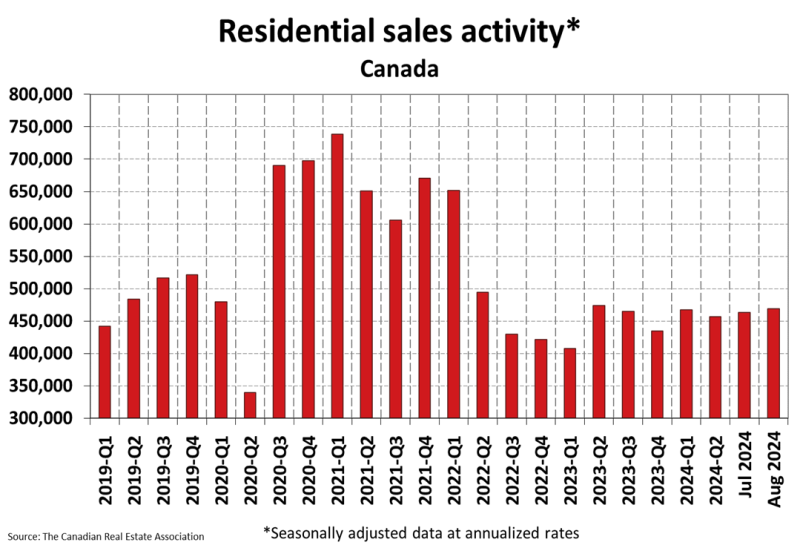

Housing Sales increased by 1.3% month-over-month in August 2024. Actual (not seasonally adjusted) sales were down by 2.1% over the prior year, August 2023.

Housing Market Headlines

- New listing activity in August rose 1.1% month-over-month - CREA

- Nationally, there were 4.1 months of housing inventory for sale at the end of August 2024. The long-term average is closer to 5 months - CREA

- Despite some fledgling signs of life to kick off the long-awaited monetary policy easing cycle, Canadian housing market activity still looks to be stuck in the same holding pattern it’s been in all year - CREA

- Fall market may be ripe for first-time homebuyers - MSN

- This latest rate cut will make things a little easier for mortgage shoppers committed to variable rates, but it’s not going to resuscitate the housing market - NerdWallet

- "Green shoots" sprouting this fall, amid prospects of lower rates ahead - RE/MAX

- Oversupply of Toronto condos due to a wave of new builds and high borrowing costs could lead to price declines - TD

- Edmonton remains a seller's market - Global News

- Vancouver home sales below seasonal averages as market finds balance - Real Estate Magazine

- Saskatchewan's housing market defies national trends with strong sales and rising prices - Real Estate Magazine

- Labour shortage in construction among obstacles facing Ottawa's housing plan - Desjardins

- In Vancouver, Calgary, and Toronto, the initial optimism following the rate cuts has waned, as home resales declined in July, erasing some of the gains seen in June. In contrast, Edmonton and Montreal experienced modest increases in activity, signaling a slow but steady recovery - RBC

- Despite affordability challenges, majority of young Canadians see home ownership as a worthwhile investment - Royal LePage

- Despite a challenging housing market and recurring headlines around housing affordability, first-time homebuyers in Canada under 30 are undeterred. Instead, they are doubling down on home ownership as a financial priority over common life milestones such as weddings - Houseful survey

- Homebuyers may be looking for more rate reductions before returning to the market en masse - Desjardins

- Most Canadian home builders plan to cut new supply in half - Canadian Home Builders Association

- Money laundering is a multi-billion-dollar problem in our market. It... crowds out hardworking families... achieving their dream of one day owning a home - OREA

- Housing starts were up 16% in July - CMHC

Do you need help with a new mortgage, renewal or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts