Monthly Market Update - August 15, 2023

Mortgage rates continue to creep higher, weighing on housing market activity.

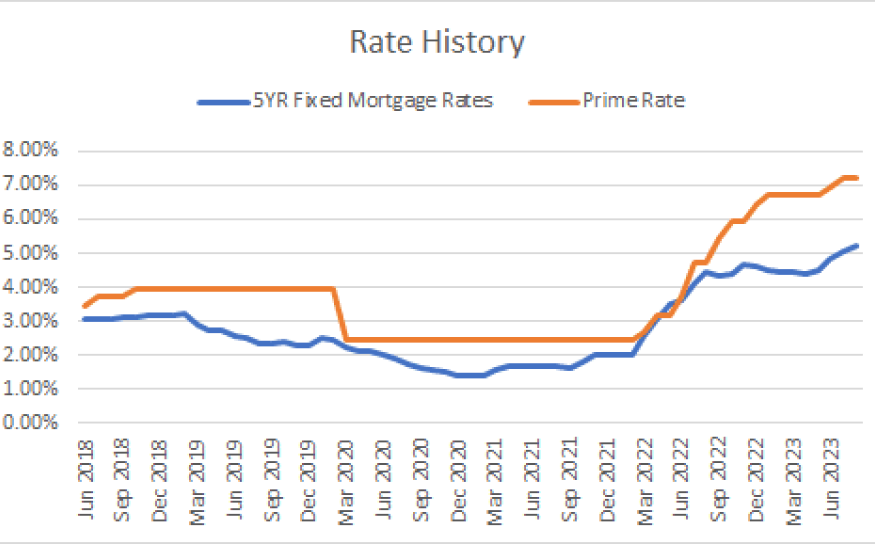

After raising rates again on July 12, the The Bank of Canada does not have another rate announcement scheduled until September 6. In the meantime, bond market yields have continued to rise over the last month, forcing fixed mortgage rates higher.

Higher rates and the usual summer slowdown has led to fewer housing sales and higher inventories of houses for sale. This could be good news for homebuyers but the high cost of mortgage financing continues to be a challenge.

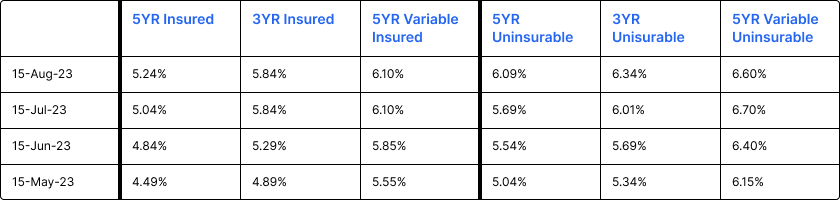

Mortgage Market

- The prime rate remains at 7.20%

- Fixed mortgage rates continue to rise, as shown below:

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Fixed mortgage rates are higher in response to bond yields increasing.

- Short-term fixed mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- The odds of another Bank of Canada rate hike have dropped but the Bank "isn't likely to change its hawkish tone" - TD

- 53% of first-time homebuyers surveyed used a different mortgage lender than their main financial institution - Sagen.

- July's weaker than expected employment stats signal a cooling economy - Statscan.

- Inflation unexpectedly rises to 3.3% in July, up from 2.8% in June.

Housing Market

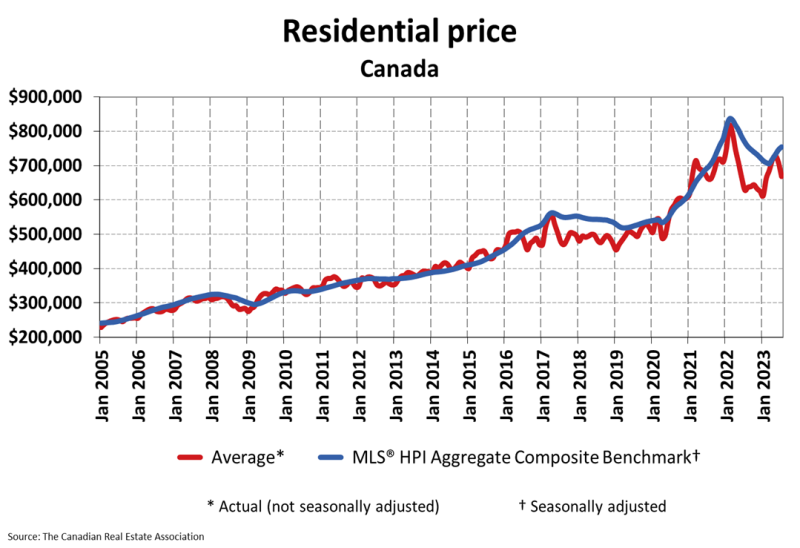

The MLS Home Price Index (HPI) was up 1.1% month-over-month in July 2023. The actual (not seasonally adjusted) national average sale price was up 6.3% year-over-year.

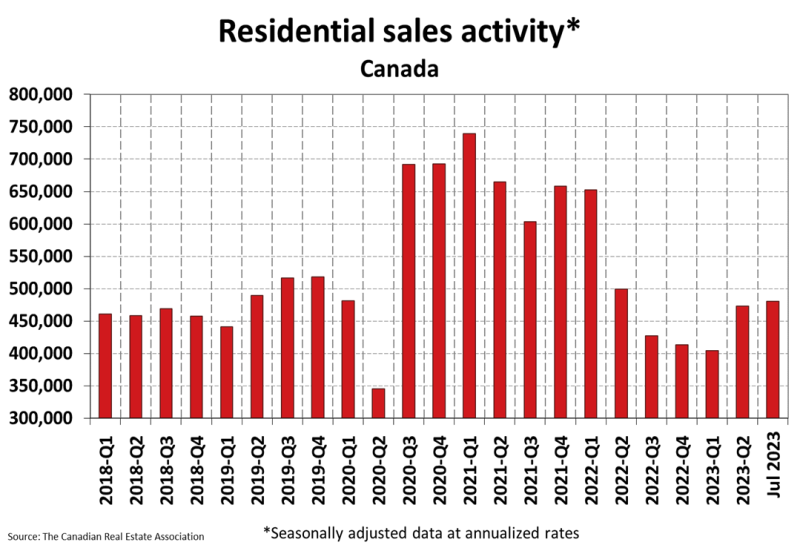

Housing Sales were down 0.7% month-over-month in July 2023. Actual sales were up by 8.7% over the prior year, July 2022.

Housing Market Headlines

- New listing activity in July rose 5.6% month-over-month - CREA

- Housing sales activity declined in all major markets in July. This ends a five month growth trend.

- "July continued along the same trend we've seen emerge in recent months, with sales levelling off and new listings returning in more normal numbers" - CREA

- The recreational property market is slowing down - Royal LePage

- CMHC says Canada needs to build an additional 3.5 million homes by 2030 to balance out supply and demand. Note that the annual target for 2023 is between 210,000 and 220,000 units. It is hard to see how such a large supply deficit can be met.

- The CEO of Re/Max is calling on all three levels of government - federal, provincial and municipal - to work more closely together to develop solutions to the current housing crisis.

- Approximately 3/4 of respondents to a recent Nanos survey say that current immigration targets will likely have a negative impact on housing affordability.

- Sagen recently released a study that made the following observations:

- 15% of Canadians that do not own a home plan to buy one in the next 24 months.

- 40% of Canadians feel there is an insufficient supply of homes.

- First-time homebuyers are now more concerned about further rate increases affecting their ability to pay their mortgage than job loss or other risks.

Do you have questions about getting a new mortgage or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts