Monthly Market Update - July 15, 2023

Mortgage rates are on the rise again as we enter a slowing summer real estate market.

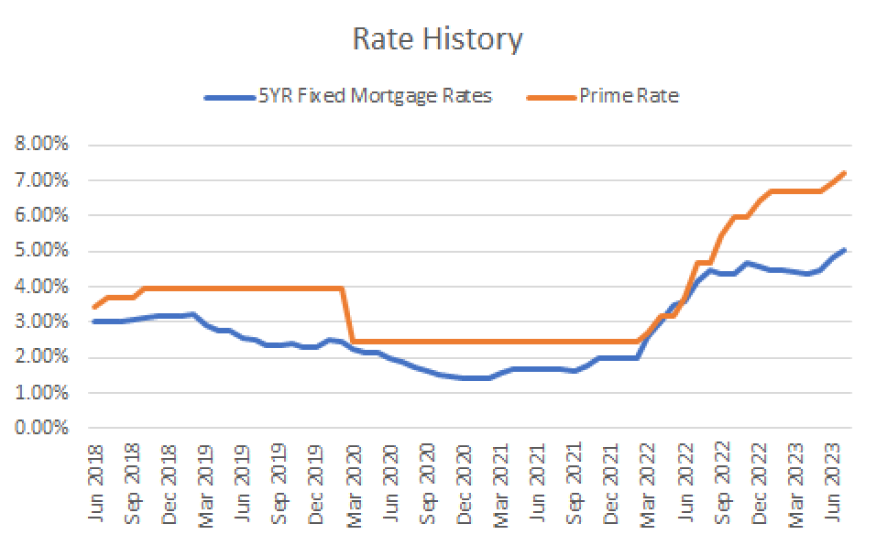

The Bank of Canada raised their base overnight lending rate by another 0.25% to 5.0% on July 12. This is the 10th increase in the last 16 months and sets the rate at the highest level since 2001. This was done despite the fact that the inflation reading for the month of May came in much lower than expected at 3.4%.

In response, the prime lending rate at major banks has increased. Variable mortgage rates are higher as a result. Fixed mortgage rates also increased in recent weeks. The housing market remained active in June, but increasing mortgage rates could cool expectations.

Mortgage Market

- The prime rate has been increased at all lenders to 7.20%

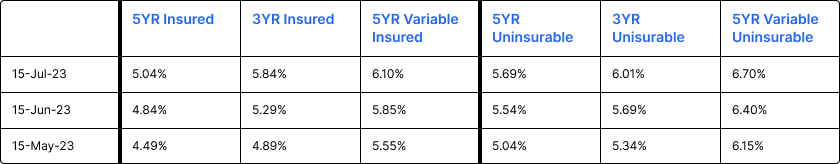

- Mortgage rates are higher in every category, as shown below:

Curious what your best mortgage rate could be today?

Mortgage Market Headlines

- Variable mortgage rates have increased by 0.25%. Lenders have increased their rates in response to the Prime rate increasing by 0.25% on July 12.

- Fixed mortgage rates are higher in response to bond yields increasing.

- OSFI has proposed changes to bank and insurer capital requirements for static-pay variable-rate mortgages due to concerns over extended amortizations. Expect this to make these mortgages 1) more expensive, and/or 2) less available.

- Short-term mortgage rates (2 & 3 year rates) remain higher than 5 year mortgage rates

- Bank of Canada likely to raise rates again in September - CIBC

- The Financial Consumer Agency of Canada has issued guidelines setting out expectations for federally regulated financial institutions to support mortgage borrowers facing severe financial difficulty and to help avoid the risk of default. Banks are expected to proactively assist stressed borrowers.

- Inflation hits a two year low, declining to 3.4%.

Housing Market

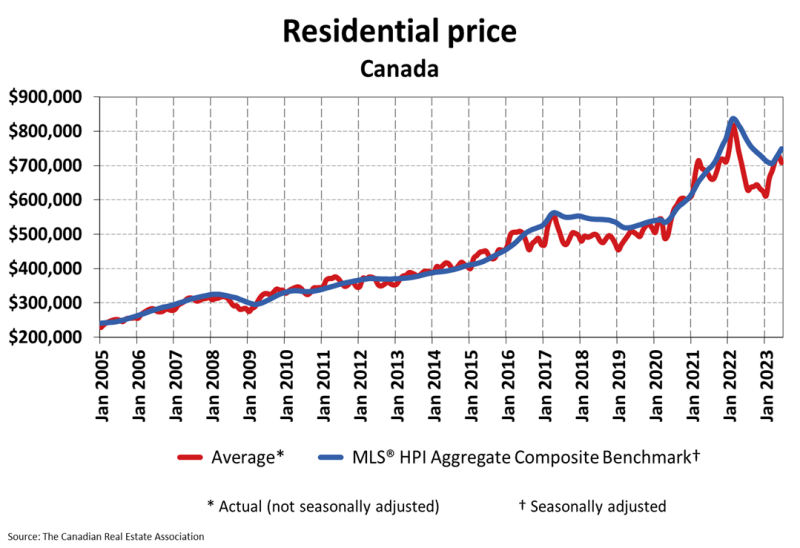

The MLS Home Price Index (HPI) was up 2% month-over-month in June 2023, but still down 4.5% compared to June 2022.

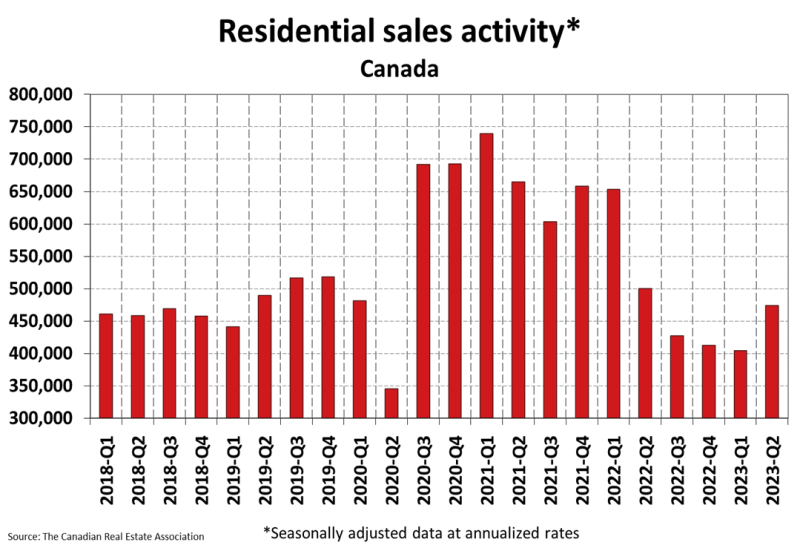

Housing Sales were up 1.5% month-over-month in June 2023. Actual sales were also up by 4.7% over the prior year, June 2022.

Housing Market Headlines

- New listing activity in June rose 5.9% month-over-month - CREA

- Sellers are seeing fewer bidding wars as the resale market slows down - Move Smartly

- Continuing Bank of Canada rate hikes appear to be negatively impacting homebuyer sentiment

- Number of first-time homebuyers worried about an insufficient down payment increased to 67% in 2023, up from 62% in 2021 and 57% in 2019 - Royal LePage

- Housing market recovery seems to be moderating - RBC

- Housing markets appear to be stabilizing heading into the summer - CREA

- 34% of first-time buyers in Canada purchased a home in a more affordable area than originally planned. Another 32% purchased a smaller home - Royal LePage

Do you have questions about getting a new mortgage or refinancing?

About The Author

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Related Posts